LED applications to drive high purity alumina (HPA) market, escalating demand for smartphones to expedite the industry growth over 2018-2025

Publisher : Fractovia | Published Date : 2018-10-18Request Sample

The commercialization graph of high purity alumina (HPA) market has been observing an exponential rise with the surging use of HPA in various consumer electronics, medical, and aeronautical applications. In fact, over the last few years, the demand for electronic products primarily mobile phones, televisions, and power banks has increased tremendously, propelling the need of HPA. More precisely, considering HPA’s excellent characteristics such as scratch resistance, high thermal coefficient, and superior brightness, LED, battery and power storage manufacturers have been preferring the product on a large scale. Indeed, even artificial sapphire glass that has been prominently used in TVs and mobile phones consists of high purity alumina as a base material.

Speaking along the same lines, the increasing requirement of electronics such as LEDs, sapphire glass, and batteries will have a significant influence on the high purity alumina industry trends. The paragraphs below elaborate how the growing inclination of public and companies toward the use of HPA across numerous end products has been augmenting the industry landscape.

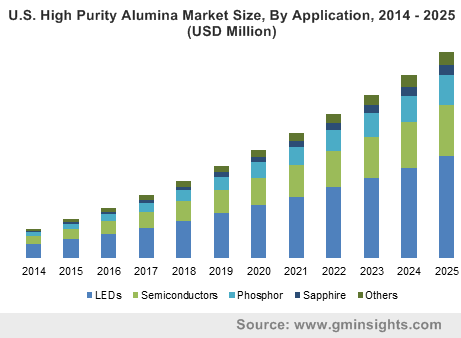

U.S. High Purity Alumina Market Size, By Application, 2014 – 2025 (USD Million)

As on today, the world is witnessing mobile, smartphone, and tablet production on an extensively large scale. In fact, a wide range of variants has been making their mark in the consumer electronics market over the last few years. In order to lend a more pleasant look to the products, mobile manufacturers have been planning to use sapphire glass in their future products. Even leading smartphone makers such as Apple and Samsung have been spending billions on R&D activities every year to enhance product features. As per reliable sources, now, Apple is working on iPhones to integrate curved screen and touchless gesture control. The efforts put in by smartphone makers to develop better, bigger, thinner, and next-generation screens are poised to propel the high purity alumina market share.

Currently, most of the smartphone makers have been facing problems of broken screens. The leading smartphone manufacturers, including OnePlus, Honor, and Samsung have been using composite materials and sapphire glass layers to make rear panel harder that will reduce the chances of screens breaking. The Chinese smartphone manufacturer, OnePlus, in fact, has used sapphire glass to make its logo which is scratch proof and glows in the dark. The prominent use of sapphire glass to minimize the chances of screen breaking is likely to impel product demand over the years ahead.

The shifting trends toward the surging use of LEDs across automotive, street lights, electronics, and residential application are testimony enough to prove the expansive growth of the overall LED market. The increasing awareness among regulatory bodies about the need of energy efficiency and excellent luminosity of the LEDs bulbs are some of the factors that have been promoting the use of LEDs. In addition, some of the governments have been encouraging the public to use LED bulbs by providing them subsidies.

Apart from the residential use of LEDs, commercially, most of the automakers have been integrating LED bulbs in their vehicles pertaining to the growing popularity of connected vehicles. In connected vehicles, LED bulbs are used to receive and send the data to the surrounding vehicles to avoid the chances of any hazard such as accidents. HPA is one of the primary materials used to manufacture sapphire substrates for light emitting diodes. Thereby, it is rather overt that the rising demand for LEDs will favorably boost the high purity alumina market size. Indeed, LEDs accounted for more than 50% of the overall HPA market share in 2017.

The growing adoption of smartphones along with continuous technological advancements related to the byproducts of HPA is slated to enhance the industry trends over the years ahead. Focusing on the surging use of HPA for myriad applications, key players in HPA market have been investing in facility expansions to accrue more revenue. Driven by the growing concern about energy efficiency and sustainability, high purity alumina (HPA) market will surpass a revenue collection of USD 4 billion by the end of 2025.