Europe graphene battery market to witness substantial gains via electric vehicle sales, Norway to be a major revenue pocket

Publisher : Fractovia | Published Date : 2017-04-28Request Sample

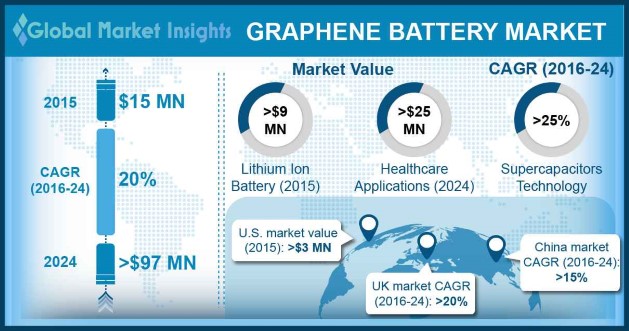

Strict legislations for maintaining ecological balance by reducing GHG emissions will lead to the cumulative growth of graphene battery market. In a bid to reduce carbon footprints in the atmosphere, electric vehicles are being adopted extensively across the globe, which will further escalate the business development prospects. Europe has witnessed maximum electric vehicle sales since the last few years, with more than 1,50,000 vehicles sold in 2015. High investments in research & development activities to enhance the shelf life, effectiveness, and quality of the battery will also boost the industry trends. As per the Global Market Insights, Inc., “Graphene Battery Industry revenue, worth USD 15 million in 2015, is anticipated to surpass USD 97 million by 2024.”

Considering the geographical trends, U.S. graphene battery industry, which had accumulated a revenue of USD 3 million in 2015, is anticipated to display a robust growth in the future. Easy availability of the product at reasonable costs coupled with the elevated demand for electric vehicles will drive the revenue.

Europe Graphene Battery Market size, by application, (USD Million), (2014 – 2024)

UK graphene battery market, estimated at USD 2 million in 2015, is anticipated to register significant gains over the next few years. Strict norms subject to the usage of batteries causing environmental pollution will propel the business space. Norway graphene battery industry is also projected to experience a hefty growth pertaining to beneficial regulations favoring the massive utilization of green technologies.

China graphene battery industry revenue, estimated at USD 1 million in 2015, is forecast to hit USD 10 million by 2024. The growth can be attributed to the substantial increase in the expansion of graphene battery production capacity. Effective supply chain management activities along with rising consumer awareness toward environmental protection will push graphene battery market size in Japan.

Based on the technological trends, graphene battery market is classified into lead acid, lithium ion, supercapacitor, and lithium sulfur. Lithium ion graphene battery industry, worth USD 9 million in 2015, is expected to grow notably over the coming years. This battery is extensively used in the automotive and healthcare sectors, resulting in low emission & energy conservation. Electronic devices such as tablets, mobiles, and laptops also make optimum use of this technology to reduce energy consumption.

Supercapacitors are expected to contribute substantially towards graphene battery market share in the years ahead, driven by their excellent charging capabilities along with enhanced shelf life.

Graphene battery finds applications across healthcare, automotive, aerospace & defense, industrial robotics, and electronics sectors. Automotive applications, which accumulated a revenue of more than USD 4 million in 2015, are predicted to contribute considerably towards industry size. Strict rules implemented by the government to reduce fuel emissions will encourage the product demand for hybrid and electric vehicles.

Graphene battery market size in the healthcare sector is expected to hit USD 25 million by 2024, owing to the rising preference for portable medical instruments. Electronics application, which contributed over 30% of the overall revenue in 2015, are projected to make notable contributions toward the overall returns on sales.

Graphene battery industry share from aerospace & defense sector application is expected to surge heavily with a rise in defense spending across developed economies. Graphene battery industry in the industrial robotics sector is expected to record a CAGR of 10% over 2016-2024

In December 2016, Huawei had launched a new graphene-assisted lithium ion battery which can endure high temperatures and can have elongated shelf life. The research displayed that this innovative technology enables lithium ion batteries to remain operational even at a temperature as high as 60 degree Celsius. Experiments also concluded that this technology enhances the longevity of the batteries.

Market players will try to increase their ROI through mergers & acquisitions and joint ventures. In 2016, Australia based company LWP technologies had made plans to acquire 50% of the shares in a newly established firm named GraphenEra Private Limited, thereby forming a joint venture with the company. This commercial enterprise is set to manufacture excellent & lighter graphene batteries with lower power consumption, lesser production costs, and durability.

Cabot Corporation, SiNode Systems Incorporation, Graphenano, Cambridge Nanosystems, Group NanoXplore Incorporation, XG Sciences Incorporation, and Graphene 3D Lab Incorporation are the key participants of graphene battery industry.