North America food pathogen testing market to chart out a profitable growth path over 2017-2024, driven by the presence of a stringent regulatory framework

Publisher : Fractovia | Published Date : 2017-10-18Request Sample

The commercialization matrix of food pathogen testing market has witnessed a remarkable surge in recent years, augmented by the stringency in food regulations implemented by renowned organizations like FDA, FAO, and EU. Food giants are continuously brainstorming new manufacturing facilities that can quickly and efficiently detect the presence of pathogens in food. With the increasing consumer awareness with reference to food safety and hygiene, food processors and testing laboratories are shifting their focus toward the deployment of high performance and effective food pathogen testing technologies - a fact that would considerably impel food pathogen testing industry outlook in the ensuing years.

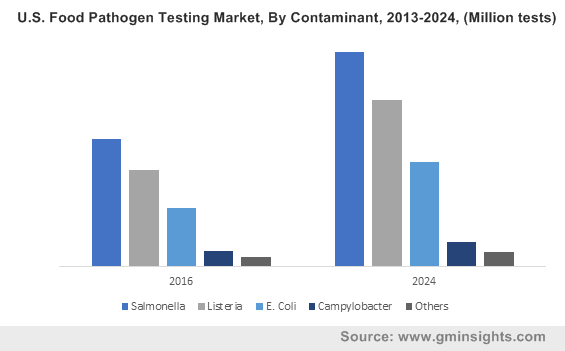

U.S. Food Pathogen Testing Market, By Contaminant, 2013-2024, (Million tests)

Prominent players in market such as 3M and Certus are continuously developing robust and innovative food safety solutions for the F&B sector, the rising prominence of which would help boost this business space. As per analysts, the robustly expanding food industry is likely to stimulate food pathogen testing market size, which was pegged at a valuation of USD 3 billion in 2016.

Elaborating further on the competitive landscape, market players are readily adopting partnership programs, joint ventures, and acquisition activities as major growth strategies. The recent acquisition of Vermont-based test kit producer, Elution Technologies by 3M stands as a testament to the aforementioned fact. Reportedly, through this acquisition, 3M has substantially enhanced its food safety offering, which experts claim, will help the tech giant bring forth innovative solutions in the food and beverage sector, thereby augmenting its position in food pathogen testing industry. In another instance, one of the leading names in food safety technologies, CERTUS™ has declared a partnership with Solus Scientific to supply the Solus Pathogen Testing System mainly across the United States. Solus’s technical expertise in the field of Escherichia coli O157, Listeria, and Salmonella pathogens, is expected to expand CERTUS’s business profile in U.S. food pathogen testing market. Speaking along similar lines, some of the other prominent biggies in food pathogen testing industry include Lloyd’s Register Quality Assurance, Inc., Bureau Veritas, Microbac Laboratories, Intertek, Genon Laboratories Ltd., RapidBio Systems, Inc.™, Det Norske Veritas, Eurofins Scientific, and SGS.

A strict regulatory framework speaks volumes and has contributed immensely toward the development of food pathogen testing industry. In 2013, the U.S. Food and Drug Administration (FDA) launched the eighth edition of the Food Code model to address the food protection and safety parameter, that retail stores and food services are mandated to adhere by. Reportedly, FDA has included several new provisions in the revised Food Code model to minimize foodborne illness as well, which would considerably impact market landscape. Numerous other initiatives have been undertaken by governmental organizations with regards to food safety and standardization, which food providers across North America are increasingly focusing on, pertaining to the growing awareness among the consumers about the adverse affect of contaminated food on health. These initiatives are likely to substantially drive North America food pathogen testing market size, which, as per estimates, will surpass a revenue collection of USD 2 billion by 2024.

The maintenance of a reliable and accurate pathogen testing framework is one of major challenges which market players are likely to face in the future, which experts cite would conveniently be resolved with the deployment of automation. The growing technological advancements prevalent in the current pathogen testing methods will thus lead to the generation of a lucrative avenue for entrants in food pathogen testing industry.

The massive ongoing developments in this market indicate the extensive scope for entrants and established players to tap into the technological domain to augment the popularity of this business space. The incorporation of biosensors and nanotechnology in pathogen detection systems is likely to bring forth numerous opportunities for the players in the coming years. Considering the future scope of this market, testing equipment developers are looking forward to developing products with high accuracy and a user-friendly design for quick results. Furthermore, in a bid to increase the lab productivity and performance, food pathogen testing equipment manufacturers are deploying automated systems at their facility centre, which will propel food pathogen testing market size, owing to the cost effectiveness and high throughput. Driven by a strict regulatory landscape, the market will surpass revenue collection of USD 5.5 billion by the end of 2024.