Fluorspar market to amass significant proceeds via robust steel & aluminum demand, APAC to majorly influence the regional landscape

Publisher : Fractovia | Published Date : 2018-02-17Request Sample

Despite being tagged as a business sphere experiencing periodic fluctuations, fluorspar market has garnered a reputation of being one of the lucrative investment grounds of the chemical industry. The robust growth of this market can be accredited to the large-scale demand for fluorspar in the production of aluminum, steel, and hydrofluoric acid. The automotive industry in this regard is poised to be a major end-use domain of market, since the business space is a key consumer of steel & aluminum materials. In fact, according to the World Steel Association, in recent years the automotive sector has accounted for almost 12% of the worldwide steel consumption – thus validating the rising demand for high performance materials such as the steel. Quite overtly, the rising quest of auto makers to incorporate light weight & flexible materials in vehicle structures has resulted in robust production of steel and aluminum, in turn stimulating fluorspar industry growth. Analyzing these trends, the global fluorspar market is expected to accrue hefty proceeds from its wide end-use spectrum. In fact, according to reliable reports, in the year 2016, the global market was pegged at USD 2 billion.

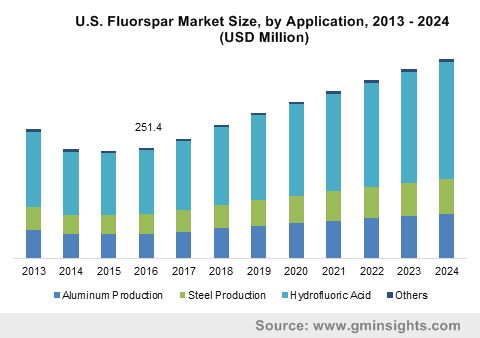

U.S. Fluorspar Market Size, by Application, 2013 – 2024 (USD Million)

Despite having enrolled its name in the billion-dollar league, fluorspar market growth has been one of the most debatable topic of recent times – majorly because of the environmental concerns linked with fluorite mining. The ill effects of air and ground vibrations, dust, noise, and fumes from the fluorite blasting process on human beings as well as property are well documented. Other factors such as the high corrosivity of hydrofluoric acid and the environmental impact of chlorofluorocarbons are also deemed to sabotage the otherwise lucrative revenue trends of market.

A succinct insight into the regional spectrum of fluorspar industry

The regional landscape of the industry has been facing a turbulent scenario, due to the environmental impact caused by surface mining. According to reports, the global ban on the CFC propellants that have been negatively impacting earth’s stratospheric layer, has caused a substantial reduction in fluorspar production since the late 80’s. However, CFC which was primarily used as an aerosol component and refrigerant witnessed a major phase out later on. The CFC ban quite astonishingly played a major role in developing new components such as the fluorine-based replacements (HFCs), which used more fluorite, providing a major push to fluorspar market growth. In this scenario, Asia Pacific, with China at the forefront, emerged as a major region accounting for more than 60% of the total industry share in 2016. In fact, the global consumption of fluorspar is dominated by China, where the product demand is currently matched by domestic production. The USA and Europe, which respectively consume around one tenth and one fourth of the global fluorspar production, as per reports, are heavily dependent on imports of fluorspar, despite Mexico being a major fluorspar producer. On that note, it is prudent to mention that Asia Pacific, with high fluorite production rates in China and Mongolia, remains a lucrative investment ground for industry players. In terms of revenue, estimates claim the APAC fluorspar market to register a y-o-y growth of 8.5% over 2017-2024.

Considering APAC’s dominance in fluorspar production, it is quite overt that the region’s major economies play a pivotal role in transforming fluorspar industry price trends. In fact, China government’s imposition of strict anti-pollution control measures in the domestic mining sector has led to fluorspar costs going through the roof. In effect, reduced supplies and growing product demand from the steel & aluminum sectors have prompted several prominent market players to adopted strategies such as facility expansions and M&As to combat high price trends and supply shortage.

A recent instance that provided renewed dynamism to the market price trends is that of Thailand’s SC Mining that has reopened its fluorspar production facility after a year’s shutdown, with an extended capacity for 24,000-30,000 tons per year. It has been reported that the mine will be producing more than 500-1000 tons per month, once operational. Experts speculate that the expansion of new capacity will benefit the regional customers who had been facing high prices due to supply shortage. Reportedly, tighter supplies of fluorite from China to the global fluorspar market because of restricted cold weather and stringent government-imposed environmental regulations have upscaled the product prices. SC Mining’s extra capacity in this regard, is anticipated to bring some reassurance to the market players that fluorspar prices will be lowered in the ensuing months.

Yet another instance demonstrating the efforts of companies to improve the volatile market scenario is that of the Bakhud deposit in Afghanistan that has reportedly announced its decision to triple its fluorspar production capacity in the next six months. According to sources, the mining giant is expected to supply the aluminum and hydrofluoric acid industries with an additional 122,500 tons per year of fluorspar.

Analyzing the current trends of this business space, it can be aptly stated that industry players are indeed rolling up sleeves and ramping up their production facilities to diversify the supply chain portfolio. Besides, fluorspar market is currently witnessing the trend of replacing fluorine-based components with more environmentally friendly alternatives, giving rise to significant R&D scope for market players, especially in automotive & air-conditioning applications. Surfing on these industry waves, it can be presumed that with new supplies on board, alternative solutions being developed, and the growing production of steel & aluminum, industry is poised to attain remarkable proceeds in the ensuing years. Validating the supposition, a report compiled by Global Market Insights, Inc., projects fluorspar industry to exceed USD 4 billion in the coming seven years.