A synopsis of fluorochemicals market in terms of the competitive hierarchy: surging development of eco-friendly products to expedite the industry expansion over 2018-2024

Publisher : Fractovia | Published Date : June 2018Request Sample

Chemours’ latest acquisition of ICOR International that generated ripples of anticipation in fluorochemicals market is a classic instance of what analysts deem the ‘tried-and-tested’ route. The leading refrigerant manufacturer, in an attempt to solidify its consumer base across North America, took over the U.S. based supplier of branded refrigerants, despite boasting of an already established liaison with equipment owners and contractors.

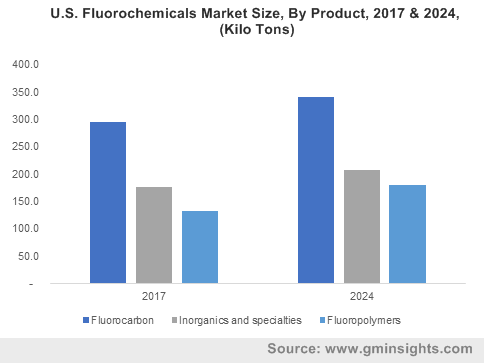

U.S. Fluorochemicals Market Size, By Product, 2017 & 2024, (Kilo Tons)

One of the essential factors encouraging giants in fluorochemical industry to carry out in-depth research and development activities is the deployment of stringent regulatory norms to phase out CFC owing to its hazardous impact on the environment. Not just Chemours, but numerous other refrigerant manufacturers are moving ahead in this regard, developing affordable, safe, and efficient products. The evolving approach of refrigerant manufacturers toward manufacturing effective products that are eco-friendly is thus likely to boost fluorochemicals market share over the years ahead.

Apart from core industry contributors, the research community has also been pulling all stops to unearth next-generation refrigerants. In fact, they are looking forward to dealing with the situation of climate change – primarily ozone depletion, given that the ozone layer has been majorly impacted by the evaporating refrigerants. Scientists from renowned firms such as Honeywell and Dupont Fluorochemicals are subsequently developing innovative refrigerants to meet the global warming potential (GWP) limit. With most of the companies having set preliminary safety and environmental standards to formulate next-generation refrigerants, fluorochemicals market trends are likely to undergo a commendable transformation in the years ahead.

Speaking about the several approaches of various companies toward obtaining a position of leadership in regional fluorochemicals industry, it would be important to mention the instance of Dupont Fluorochemicals. In 2014, this established contender had extended its product portfolio with the development of sustainable refrigerants. These refrigerants have very less GWP limit on account of which they had been introduced as a replacement for regulated high-GWP refrigerants. This approach of Dupont toward the development of these low GWP refrigerants has set a benchmark for the other giants in fluorochemicals market. With a number of regulatory bodies are demanding the reduction of dependency on hydrofluorocarbons, the launch of refrigerants having a low GWP is a welcome change. As of now, Dupont has also been investing millions of dollars in research and development activities to launch sustainable refrigerants that would not have any effect on the ozone layer.

In addition to the R&D activities, companies have been framing long-term plans to increase their manufacturing capacities and introduce a widespread range of products. Validating the aforementioned fact, the Indian refrigerant manufacturer, Gujarat Fluorochemicals had recently expanded its refrigeration gas facility to increase its existing production capacity and extend its reach across the Indian sub-continent. Such strategic business initiatives are expected to generate lucrative opportunities across the emerging economies, charting out a positive growth path for Asia Pacific fluorochemicals market. Reportedly, driven by the contribution of its major revenue pockets including China, India, and South Korea, APAC fluorochemicals industry size is expected to cross 2.5 million tons of production by the end of 2024.

The European region is extensively under scrutiny when it comes to fluorochemicals industry. Merely a few days before, the EPA listed fluorochemicals under hazardous substances taking into account the impact of its toxicity on environmental status. In consequence, major companies are looking forward to bringing forth a spate of alternative refrigerants that may not harm the environment. Despite the strict regulatory scenario however, Europe will register an annual growth rate of more than 3% over 2018-2024, owing to the surging use of fluorochemicals in medical implants and automotive applications.

The frequent launch of highly advanced products with low GWP is likely to propel the industry growth over the years ahead. Most of the contenders of fluorochemicals market have been working to adopt advanced technologies to increase production capacity. Additionally, they have also been working to implement numerous other strategies such as new product development, JVs, and acquisitions to achieve a competitive position in fluorochemicals industry. With the rise in manufacturing facilities, the affordability of refrigerants would gradually increase, considerably influencing fluorochemicals market size, which is expected to generate a revenue of USD 70 billion by the end of 2024.