Converted FPSO industry to witness a massive growth rate over 2016-2024, U.S. to majorly drive the global demand

Publisher : Fractovia | Published Date : 2017-05-25Request Sample

The escalating global demand for oil & gas coupled with the rise in the number of offshore oil exploration activities will spur FPSO market size. Renowned oil companies have been undertaking initiatives to bring about massive business expansion. For instance, Yinson Holdings Berhad, a Malaysian firm involved in FPSO activities, has produced oil three months prior to its deadline, at its storage and offloading FPSO unit in Ghana. Escalating demand for converting tank vessels into FPSO (floating, production, storage & offloading) units to reduce capital expenditure will encourage new entrants to invest in this lucrative business. According to Global Market Insights, Inc., “FPSO industry revenue is slated to hit USD 117 billion by 2024, growing at a rate of 19% over the period of 2016-2024.”

Based on the product trends, FPSO market is classified into new built, converted, and redeployed products. Converted FPSO industry, which contributed more than 63% of overall revenue in 2015, is projected to witness an annual growth of 18.9% over the coming seven years. The growth can be attributed to the fact that these products require relatively lesser investments as compared to the construction & designing of new FPSO units. The product’s ability to operate across medium & small offshore regions will influence the industry revenue.

Norway FPSO market size, by volume, 2014 - 2024 (Units)

Redeployed FPSO industry, which was estimated at USD 719 million in 2015, is projected to observe an enormous expansion over the years ahead subject to the capability of the product to quickly execute the project in hand as compared to the newly converted or newly built FPSO units.

Considering the topographical landscape, Norway FPSO industry is anticipated to surpass a targeted revenue margin of USD 3.1 billion by 2024. The expansion can be credited to the rapid increase in the number of oil & gas well surveys across the region. FPSO industry size in the U.S., which was estimated over USD 20 billion in 2015, is anticipated to register notable gains over the coming seven years, pertaining to the large-scale presence of oil & gas fields, development of new offshore fields, and high investments in oil & gas activities.

China FPSO market size, which was evaluated at USD 687 million in 2015, is foreseen to experience a lucrative growth rate over the next few years. The growth can be credited to the rise in the number of exploration & drilling activities across offshore destinations. Angola FPSO industry is predicted to make notable gains of over 26.4% between the duration from 2016 to 2024, owing to rise in investigation & drilling activities carried out across deep-water oil reservoirs. Furthermore, Exxon Mobil, Eni S.p.A, and Chevron corporations have also launched offshore projects in the region and added a capacity of nearly 1MMbbl/d.

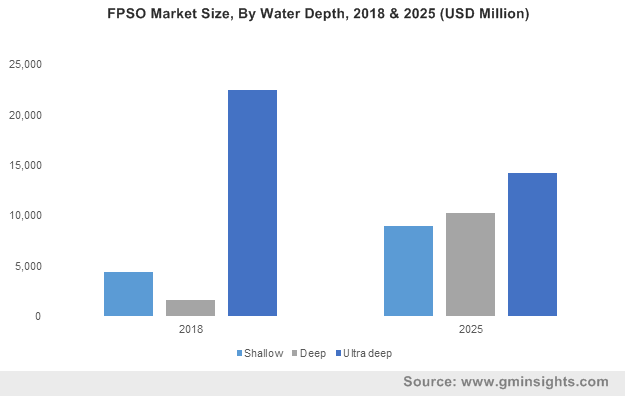

Depending on the FPSO exploration & production activities carried across various water depth levels, FPSO industry is segmented into ultra-deep, shallow, and deep waters. Shallow water depth FPSO market is anticipated to hit the revenue of USD 23.28 billion by 2024, growing at a CAGR of 19.5% during the period from 2016 to 2024. Deep water FPSO industry, which contributed more than 59% of the global revenue in 2015, is slated to witness an appreciable growth over the years ahead. FPSO industry growth will also be characterized by high capital investments across deep-water offshore exploration & production ventures.

Market participants will try to increase their ROI and geographical presence through product benchmarking, strategic alliances, joint ventures, new product launches, and product differentiation. BW Offshore, Hyundai Heavy Industries Company Limited, SBM Offshore N.V., Samsung Heavy Industries Company Limited, Yinson Holdings Berhad, MODEC Incorporation, Teekay Corporation, Aker Solutions ASA, and Bluewater Water Energy LLP are the key players of FPSO industry.