Flanges market to record substantial gains from wastewater management sector by 2025

Publisher : Fractovia | Published Date : 2019-07-12Request Sample

Flanges market is anticipated to amass significant proceeds over 2019-2025 due to increasing activities witnessed in the oil and gas industry as well as wastewater management, given that both the sectors involve expansive usage of pipelines. Flanges are used in connecting pipelines, pumps and valves to provide easy access for cleaning, inspection and maintenance. Demand of non-corrosive material in manufacturing flanges for pipelines will drive flanges market trends in the forecast duration.

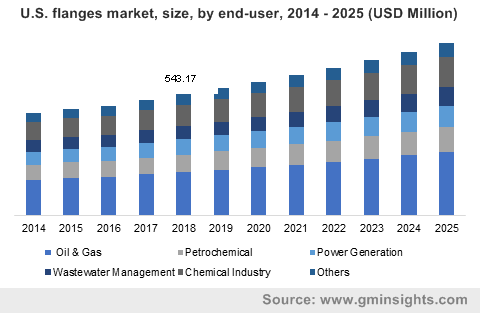

U.S. flanges market, size, by end-user, 2014 – 2025 (USD Million)

The most preferred material for producing flanges is stainless steel due to its higher tensile strength, hardness, ductility, and anti-corrosion property. The production of steel is also increasing across the globe which will add stimulus to stainless-steel flange manufacturing. Stainless steel is estimated to account for 45% of the flanges market share by 2025.

Expansion of stainless-steel industry will have a direct consequence on flanges market outlook. In the year 2018, the global stainless melt shop production was reported to be 50,729 metric tons. The compound annual growth rate of stainless steel from 1980-2018 has been noted to be 5.40%. China is one of the leading nations as far as stainless-steel production is considered – the region produced 52.6% of global stainless steel volume in 2018, accounting for a production of 26,706 metric tons, which would majorly drive the regional flanges market trends.

Driven by the contribution of China in stainless-steel production, APAC is certain to accrue substantial proceeds by 2025. Asia Pacific in 2018, apparently accounted for about 50% of flanges market share in 2018 and the continent’s growth graph is expected to show an exponential pattern over the coming years.

In the European Union, in 2018, the stainless-steel melt production was approximately 7,385 metric tons. Europe represented around 14.6 percent of the stainless-steel production worldwide in the same year. The region will offer a significant growth scope to flanges industry owing to the abundantly available raw materials and large pipeline networks to serve the huge regional population. Europe is forecast to be among the key regions for flanges market, having accounted for a share of 20% in 2018.

Rising expansion of pipelines to increase international trade is expected to drive flanges market growth. To elaborate, last year, a project to deliver gas from Eastern Mediterranean to Europe had been announced, with an investment of approximately $7 billion. On completion, the project will be supplying gas to the European market while more countries can also access the pipeline by reaching an agreement. Similar such pipeline projects are expected to be finalized in the coming years, which would certainly add a positive impetus to flanges industry share.

Apart from the contribution of gas pipeline projects, water pipelines being laid for water treatment and sanitation will also help flanges industry to expand its revenue potential. Owing to the rising awareness about wastewater management programs worldwide, government authorities have been emphasizing on the development of wastewater treatment and sanitation facilities which in turn will boost flanges market share. As flanges help in easy assembly and disassembly of pipelines, they help in maintenance and cleaning to ensure constant liquid flow and allow safety of marine environment. High corrosion resistance of stainless-steel flanges makes them the most preferred material to be used in wastewater management plants.

Due to the growing scarcity of water, water treatment activities is expected to increase to meet the planet’s clean water demand. Flanges market size expansion can be majorly accredited to the proliferating construction of water pipelines.

Rising automation and modernization trends have been incessantly transforming flanges industry outlook. Major players have been making efforts to increase their production and revenue share to accelerate the flanges market growth. For instance, in line with the strategy for digital transformation, a Finland-based stainless-steel flanges manufacturing company Outokumpu has reportedly been working to digitalize its largest factory in Tornio, Finland. The firm has planned to transform the factory into the most cost-competitive and digitalized operation in the industry by the year 2020. After Tornio, digital manufacturing may be rolled out to other production units of Outokumpu globally.

Commendable growth strategies by flanges industry players to modernize their production capacity is anticipated to propel product demand considerably. Advanced manufacturing techniques by various competitors is also likely to expand the flanges industry share by the year 2025.

Some of the most important participants of flanges market fall along the likes of Pro-Flange Limited, Texas Flange, General Flange and Forge, Outokumpu, and Sandvik Materials Technology. As per estimates, flanges market size is forecast to surpass $6 billion by 2025.