Feed micronutrients market to experience prominent gains from Europe over 2017-2024, surging demand for animal protein from meat & milk products to foster the industry growth

Publisher : Fractovia | Published Date : August 2017Request Sample

Cargill’s most recent acquisition of Southern States’ animal feed business is a positive beacon of hope for the roadmap of feed micronutrients market. The deal encompasses seven feed mills belonging to the Virginia-based animal feed manufacturer, and grants Cargill the exclusive rights to the products and customer relationships related to Southern States Cooperative’s animal feed business. Through this acquisition, Cargill intends to expand its foothold in the southern and eastern regions of U.S. feed micronutrients industry. For the record, the company already has a strong presence in more than 40 countries, with a workforce of more than 20,000. Post the closure of this deal, three months hence, the feed micronutrients market giant plans to bring in more innovative platforms, subsequently align nutrition abilities, and bring forth a competent trading and risk management strategy, which will eventually advocate the strengthening of its position in global liquid feed industry.

Cargill’s deal with Southern States comes hardly a month post its minor acquisition of Delacon, an Austria-based animal feed additives market player. Having attained successes with lucrative back-to-back deals, Cargill is on its way to profitably consolidate its presence in feed micronutrients industry, slated to cross a projected valuation of USD 2 billion by 2024. However, it is not the only company that has been making headlines in the animal feed forum. Aboitiz Equity Ventures (AEV) Inc., a holdings and management company, recently hit the tabloids when it expanded its animal feed business in Vietnam. As per reports, the company has acquired a major stake of 70% of Vietnam’s Eurofeed (Europe Nutrition Joint Stock Co.) for a valuation of around USD 3.7 million. Having conducted the acquisition through its wholly-owned subsidiary, Pilmico International, AEV plans to contribute its bit toward the growth curve of feed micronutrients market. Not to be left behind in the race, companies such as Aries Agro, Agrium Advanced Technologies, Keshav Fertilizers, and Gawrihar Bio-Chem have also adopted numerous growth strategies to consolidate their business presence in feed micronutrients industry.

U.S. Feed Micronutrients Market Size, By Product, 2016 & 2024 (USD Million)

The commercialization potential of feed micronutrients market has been forecast to be colossal, given the extensive demand for meat and dairy products rich in protein. A report by Global Market Insights, Inc., predicts that feed micronutrients industry size is estimated to surpass a mammoth valuation of 2 billion tons by 2024. Animal feed is essentially fed to poultry, livestock, ruminants, and swine, to enhance their growth rate, provide their body with essential nutrients, and enable better health. The rising demand for milk & meat products pertaining to the ever-growing population is one of most essential factors driving feed micronutrients market. Enlisted below are some essential statistics with reference to animal feed market, which may provide a deeper understanding as regards to the factors driving feed micronutrients industry.

- Animal agriculture is one of the most opportunistic businesses in terms of providing employment and increasing the economic growth. As per the American Feed Industry association (AFIA), this business sphere is responsible for contributing more than USD 375 billion to the U.S. economy alone. Besides, it provides nearly 2 million jobs and a subsequent valuation of almost USD 18 billion in household incomes.

- The United Nations Food and Agriculture Organization (FAO) states that the demand for food will grow by an astonishing 60% by 2050, while animal protein production will depict a y-o-y growth of around 1.7% between 2010-2050.

- The U.S. FAO also declares that the aquaculture production may rise by 90%, meat production by nearly 70%, while dairy production by 55%, over 2010-2050.

- Global meat production has increased by three times its value over the last 40 years, while the last decade depicted a rise of almost 20%.

These statistics affirm the fact that feed micronutrients market has tremendous growth prospects over 2017-2024. Feed nutrients such as zinc, copper, vitamin A, etc., are specifically important for the health maintenance of livestock, the consumption of which has been increasing by the day. As per reliable estimates, globally, the demand for livestock products is expected to almost double in South Asia and the sub-Saharan region - to 400 Kcal/day/person by 2050 from 200 Kcal/day/person in 2000, which will substantially propel feed micronutrients industry.

Poultry, undoubtedly, has been forecast to be one of most lucrative sectors of this fraternity, and is expected to procure a significant chunk of feed micronutrients market – the target valuation of this sector has been estimated to cross USD 990 million by 2024. This growth can be credited to the rising meat and egg consumption across numerous geographies, especially India and China. As per records, animal feed production from July 2016 to June 2017 for poultry rose up by 2%, which is a positive indicator of the rising poultry feed demand across the globe. With the global rise of more than 80% in the demand for meat, feed micronutrients industry will indeed carve out a lucrative growth map over 2017-2024.

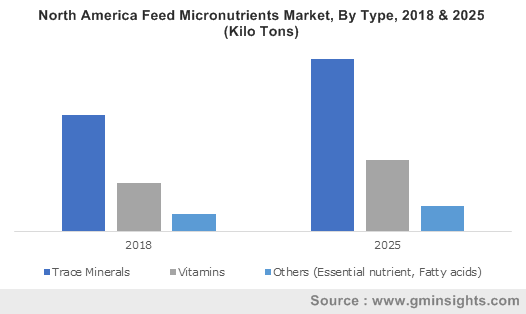

An insight into the product landscape of feed micronutrients market:

- Trace minerals, though required in small quantities, are one of the most vital nutrients that help to shape the animal’s health. Estimates claim feed micronutrients industry size to be around USD 446 million in 2016.

- Iron, one of many trace minerals encompassed in feed micronutrients market, helps in the production of hemoglobin, while manganese helps in effectively utilizing carbs.

- Zinc is responsible for effective skeletal development, carbohydrate, fat, & protein utilization, and efficient growth rate. As per estimates, zinc-based feed micronutrients industry size is likely to cross USD 350 million by 2024, subject to the awareness that its deficiency leads to hair loss, fertility problems, poor wound healing, and muscle cramping in animals.

- Another effective trace mineral is copper, which effectively aids iron absorption and metabolism improvement. On these grounds, it has been forecast that copper-based feed micronutrients market will grow at a rate of 6% over 2017-2024.

The last few years have witnessed a massive surge in the demand for animal protein from dairy, fish, and livestock, subject to which analysts deem feed micronutrients industry to be one of the fastest growing markets of recent times. Of late, this business space has been witnessing a slew of innovative trends. For instance, scientists at the Finland-based VTT Technical Research Centre and the Lappeenranta University of Technology have invented a methodology with the help of which single-cell protein can be manufactured from carbon dioxide and electricity. Eventually, the researchers plan to develop this protein into a fully-functional animal feed, which will enable on-the-demand feed production for livestock. As per reports, this protein mixture encompasses 25% carbs and 50% proteins, and is likely to undergo changes that may bring about the incorporation of minerals and vitamins as well. In the event that the production goes mainstream, this trend of manufacturing nutritious feed may go down the annals of feed micronutrients market as one of most path-breaking trends ever.