APAC exoskeleton market to register the highest CAGR over 2019-2026, regional industry to be characterized by the appreciable efforts from industry contenders to launch innovative products

Publisher : Fractovia | Latest Update: 2019-02-22 | Published Date : 2017-10-09Request Sample

The Wyss-ReWalk partnership inked in Q3 2017 sent out waves of anticipation across exoskeleton market, based on the premise of the fact that both the organizations have been striving toward helping people with physical impairments. Elaborating further, ReWalk recently made it to the headlines for working on an exoskeleton designed to enable stroke affected patients regain their mobility. In consequence, the firm signed a partnership with the Wyss Institute, Harvard, renowned for specializing in the development of innovative technology powered by biological design principles.

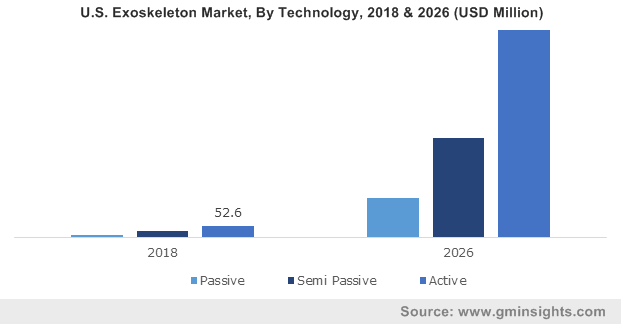

U.S. Exoskeleton Market, By Technology, 2018 & 2026 (USD Million)

ReWalk’s current brainchild, dubbed Restore, functions similar to a swing, with a belt joined to a single leg brace targeting the joint that a stroke impacts the most – the ankle, so that patients may get over the inertia and move their leg in the forward direction to regain mobility. The exoskeleton is endowed with sensors monitoring the speed parameter, to hasten or slow down the wearer’s stride. Restore has already garnered rave reviews across exoskeleton industry, despite the fact that this business space is afloat with numerous exoskeletons for paraplegics manufactured by eminent companies. In effect though, it is quite apparent that the popularity of these devices has majorly catapulted exoskeleton market size.

Irrefutably, the healthcare industry will stand to be one of the most lucrative application arenas for the global exoskeleton industry. As a matter of fact, the expanding requirement for rehabilitation for gait disorders such as Parkinson’s disease and other spinal cord injuries will drive the deployment of exoskeletons in healthcare centers. This in consequence will augment exoskeleton industry size from healthcare applications, which is projected to dominate the overall market share over 2019-2026.

APAC exoskeleton industry outlook: Increased deployment of wearables to spur the regional growth

Asia Pacific has been proclaimed to emerge as the next lucrative growth ground for exoskeleton market, given the robust demand for wearables in the region. The growing geriatric population in the continent, vulnerable to strokes and mobility issues, would demand the deployment of rehabilitation therapy procedures. This would subsequently necessitate the requirement of advanced exoskeletons designed to help patients with gait training and the like, thereby providing a boost to APAC exoskeleton industry share.

Most of the companies headquartered in the Asia Pacific have reportedly been striving toward developing innovative products that would be deployed across the military and healthcare sectors. For instance, the South Korean automotive giant, Hyundai Motor Company, recently made it to the headlines for having developed an exoskeleton called the H-MEX (Hyundai Medical Exoskeleton), especially designed for paraplegics. Having debuted at the CES 2017, H-MEX is the firm’s first exoskeleton and is manufactured to allow patients paralyzed from below the waist to regain balance, in addition to improving the blood circulation among patients.

In yet another instance, a state-owned Chinese manufacturer, in the year 2018, launched military exosuits with the intention to boost the overall weight carrying capacity of the armed forces. In this regard, it is also prudent to mention that the China Shipbuilding Industry has deployed exoskeletons to be of help to shipyard workers, while military engineers have gone ahead and developed L-70 for their armed forces applications.

Pertaining to the appreciable efforts undertaken by companies to come up with a unique product portfolio, APAC exoskeleton market size is likely to be worth a commendable remuneration by 2026. Economies such as Japan, China, India, and South Korea have also been investing heavily in R&D projects, subject to which Asia Pacific exoskeleton industry share has been projected to exhibit the highest growth rate over 2019-2026.

Backed by a barrage of R&D projects targeted toward treating physical impairments, exoskeleton market stands to gain much in the ensuing years. While a considerable number of device deployments have already witnessed success early on, the commercialization scale of this business sphere is still in its nascent stages.

In an effort to bring exoskeleton industry to the mainstream arena, renowned firms along the likes of Ekso Bionic, Panasonic, ReWalk, Lockheed Martin, Cyberdyne, and REX Bionic have been attempting to generate a portfolio of extensively innovative products that may rapidly make inroads into the industrial, healthcare, and military sectors. In consequence, this would culminate into robust product sales and popularity, thereby augmenting the profitability landscape exoskeleton market to quite an appreciable frontier in the many years to come.