Asia Pacific EPDM Market to witness highest gains over the coming six years, automotive applications to drive the regional share

Publisher : Fractovia | Published Date : 2017-05-19Request Sample

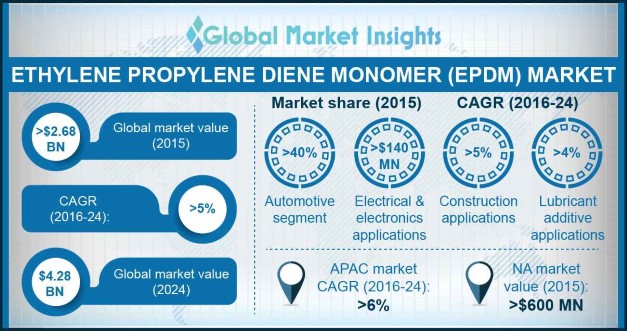

Ethylene propylene diene monomer market will continue to be one of the most significant and fastest growing synthetic rubber industries in the years ahead. Catalyst technologies and advanced polymerization techniques that are commonly in use today enable highly customized polymer designs which can meet specific consumer needs. Versatility in polymer design and superior performance allow broader adoption of this particular category of synthetic rubbers among various end-use industries which include construction, automobile, plastic impact modification, roofing membrane, electrical insulation etc. Excellent resistance to heat, ozone, oxidation, and weather aging is expected to offer remarkable value to EPDM industry from demanding applications. As per a report by Global Market Insights, Inc., “Ethylene propylene diene monomer market is slated to record a revenue over USD 4 billion by 2024, growing at a CAGR of more than 5% over the period of 2016-2024.”

Holding the dominant position in the global market in 2015, Asia Pacific EPDM industry is expected to register the highest annual growth rate of more than 6% over 2016-2024. The noteworthy propulsion of the regional market can be grounded on the ever-expanding construction industry in this belt. Growing population especially in emerging nations like India and China which have boosted the overall infrastructure spending can be taken as a major driving factor propelling ethylene propylene diene monomer market trend. China for an instance in 2015, spent around USD 1.7 trillion for constructional purposes. High demand for the product for roofing in construction will proportionally compliment EPDM market outlook in the coming years.

U.S. EPDM Market size, by application, 2013-2024 (USD Million)

Another escalating industry which has left a direct impact on the regional industry growth is automotive. India alone is presumed to contribute significantly toward the overall market share by collecting a revenue of USD 130 million by 2024.

The broader application portfolio of EPDM in automotive sector makes it one of the crucial factors influencing the overall market trends. Accounting for almost 40% of the overall market, automotive segment led the application landscape in 2015. These polymers are extensively used in inner tire tubes, ream lamp baskets, belt drives, front and rear bumpers, door seals, the interior panel of cars etc. a tremendous escalation in the production of both personal as well as commercial vehicle is anticipated to complement the growth curve of EPDM industry. Market demand from construction applications on other hand is expected to grow significantly at a CAGR of 6% over 2016-2024. Increasing constructional and renovation activities, especially in BRICS nations, is catering substantial expansion of ethylene propylene diene monomer market.

Apart from these two key application domains, plastic impact modification unit has also established strong grounds enhancing the overall EPDM market dynamics. These synthetic polymers are the main raw materials that are used for modification of thermoplastic vulcanizate (TPV) and thermoplastic olefins (TPO). Improved strength and light weight characteristics make TPO the most preferred choice for automotive as well as construction applications. Global TPO market is estimated to cross 1500 kilotons within the next seven years, which in a way will act as a growth enhancer for EPDM industry. U.S plastics applications were more than USD 60 million in 2015, and is forecast to experience an upswing in the growth chart at a projected CAGR of 4% over the period of 2016-2024. Overall U.S. ethylene propylene diene monomer market is slated to reach USD 940 million by the end of 2024.

The production capacity of these synthetic rubbers, where on one hand, have witnessed a steep expansion over the past few years by the heavy investments of the industry plyers, on the other hand have resulted in an oversupply of the product. This aspect has negatively impacted the EPDM market price trends. Along with this, as petroleum based products are a must in the production of these polymers, volatile crude oil price trends may hinder the development of the industry. However, growing manufacturers’ preference for bio-based EPDM products will open new opportunity for the market in the coming time. Some of the prominent ethylene propylene diene monomer industry participants include SK Global Chemical Co., Exxonmobil Chemical Company, Petrochina Co. Ltd., Mitsui Chemicals Inc., Versalis, and Mitsui Chemicals Inc.