An outline of encapsulated flavors and fragrances market in terms of the growth strategies adopted by leading industry players

Publisher : Fractovia | Published Date : 2018-07-26Request Sample

With an overall business valuation of more than USD 6 billion in 2017, encapsulated flavors and fragrances market has been drawing a great deal of attention from investors lately. In fact, the entire encapsulation trend has become a major focus and has come into the limelight in most of the industries including chemicals, food & nutrition, pharmaceutical, and textile. Given the benefits such as reduction in quantities of raw materials, improved shelf-life, and enhanced flavor and taste, encapsulation has pretty soon become a mainstream technology.

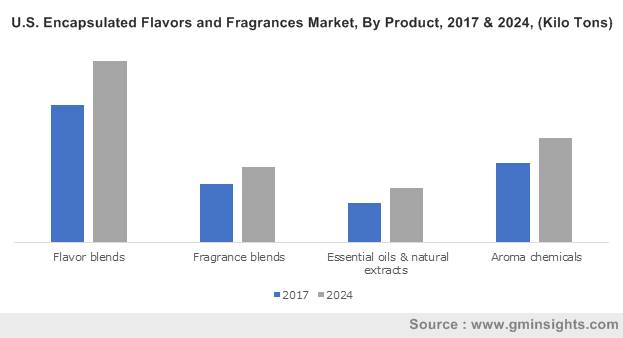

U.S. Encapsulated Flavors and Fragrances Market, By Product, 2017 & 2024, (Kilo Tons)

Speaking of the commercialization potential of encapsulated flavors and fragrances market, the increased demand for these products through industries such as F&B, home & personal care, and medicine are expected to open significant growth & investment opportunities for shareholders in the ensuing years.

Besides thriving on the cusp of a widespread application spectrum, global encapsulated flavors and fragrances market has also evolved on the backdrop of intense competitive landscape. The robust demand for functional food products across myriad geographies have prompted industry players to expand their reach by adopting some tried-and tested growth strategies such as product innovation, M&As, R&D, new technology launches, and strategic collaborations.

In a bid to expand its presence across the Latin America encapsulated flavors and fragrances market, the Swiss behemoth, Firmenich has recently inaugurated a manufacturing plant in Sao Paulo, Brazil, for developing encapsulated flavors. This move, reportedly is expected to increase the speed-to-market parameter of Firmenich’s core encapsulated flavor technologies. The significant investment also depicts the strategic importance of Brazil, a critical market for Firmenich and its product portfolio.

Another vital instance is that of Archer Daniels Midland Company that acquired the full ownership of Amazon Flavors in 2016, a renowned Brazilian manufacturer of emulsions, natural extracts, and compounds. These instances stand as a significant testimony to the fact that Brazil is a key market for the companies trying to reinforce their stance in the Latin America encapsulated flavors and fragrances market through facility expansions and acquisitions that have been identified as effective moves.

Further elaborating on the geographical landscape of encapsulated flavors and fragrances industry, it would be prudent to state that North America has emerged as a lucrative growth ground for potential investors. Accounting for more than 30% of the overall industry share in 2017, the regional encapsulated flavors and fragrances market is expected to witness robust demand through rising consumer health & diet related concerns, attempts to improve product shelf life, and demand for dietary medical supplements. Growing investments in the U.S. market to cater to the increasing demand for encapsulated flavors and fragrances is further anticipated to propel the regional remunerative portfolio.

An instance bearing testimony to the aforesaid statement is of the prominent industry player International Flavours and Fragrances that started a new company dubbed as Tastepoint in June 2017. Through its new arm, IFF expects to further increase its share in the U.S. market, while catering to the greater demand for encapsulated chocolate flavor in the region.

The prodigiously broadening regional and application horizon of encapsulation technologies has had a massive impact on encapsulated flavors and fragrances industry trends, uplifting this business sphere to position its name in the billion-dollar fraternity. A report by Global Market Insights, Inc., further sheds light on the growth dynamics of encapsulated flavors and fragrances market, claiming its remuneration portfolio to surpass USD 8 billion by 2024. The report also forecast that Asia Pacific encapsulated flavors and fragrances industry will be the fastest growing region with an estimated y-o-y growth rate of 4.5% over 2018-2024.

One of the prominent instances validating the potential investment trend in Asia Pacific encapsulated flavors and fragrances industry is of a flavors firm Silesia that has announced to open a new plant in Singapore. A burgeoning food industry in the Southeast Asia, excellent growth opportunities, and the need to better cater to robust customer demands have impelled industry players to expand their footprint with new encapsulated flavors, facilities, and innovative technologies in the region.

Analyzing these instances, it wouldn’t be wrong to quote that the transformation in the competitive hierarchy will be one of the topmost intriguing trends to watch for in the years ahead. Driven by a highly intense competitive scenario and product demand, global encapsulated flavors and fragrances market is expected to carve a lucrative roadmap over the following years.