Embolic protection devices market to reach the billion-dollar benchmark by 2024, product innovations to characterize the industry landscape

Publisher : Fractovia | Published Date : 2018-03-19Request Sample

Contego Medical’s declaration of commencing the enrollment in PERFORMANCE I Trial sent out waves of anticipation in embolic protection devices market. Reportedly, this enhanced clinical trial is particularly designed to assess the feasibility and safety of the company’s flagship Post-Dilation Balloon System and Neuroguard IEP® 3-in-1 Carotid Stent. Intended for carotid artery stenosis treatment, this 3-in-1 Integrated Embolic Protection System has already grabbed majority of the limelight in embolic protection devices industry recently. Sources state - the system encompasses absolutely novel carotid stent that claimed to offer continual micro-embolic protection even during most vulnerable stage of the surgical procedure. Experts’ believe the decision of bringing onboard PERFORMANCE I Trial enrollment depicts Contego Medical, LLC’s commitment toward their consumers and also a measure to enhance its portfolio in the overall business space.

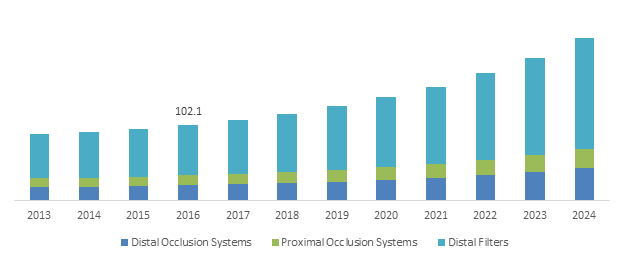

Germany Embolic Protection Devices Market Size, by Product, 2013-2024 (USD Million)

Powered by the humongous application in neurovascular space, embolic protection devices industry is set to attain remarkable proceeds over the ensuing years. Testament of the fact is the forecast valuation which claim the overall market to surpass billion-dollar frontier by 2024. A major credit of this goes to the increasing occurrence of cardiac diseases, both across developed as well developing economies. According to the latest Heart Disease and Strokes Statistics claimed by American Heart Association - 1 in every 3 casualties in U.S., which is almost 801,000 in total, results from cardiovascular diseases. Nearly 2200 Americans die every day out of cardiac disorder- estimates further backing the profitable roadmap projected for embolic protection devices industry.

Amidst the dynamically intense regional share battle, Asia Pacific has turned out to be a hotbed for potential investors. Increasing geriatric populace vulnerable to respiratory disorder, rising disposable incomes, and subsequent development in regional healthcare infrastructure are few of the prominent factors fueling the regional embolic protection devices industry share. While in 2016, Japan procured a percentage of authority in APAC market, of late, India and China are also gearing up to become potential growth grounds for the regional embolic protection devices market.

Citing an instance that made it to the headlines in India embolic protection devices market recently, InspireMD, Inc has announced the successful treatment of the first patient with its flagship product, CGuard™ EPS. Reportedly, the operation was performed by a renowned interventional neuro-radiologist at Shri B. D Mehta Mahavir Hospital in Surat. The case somehow acted as a major milestone for the regional embolic protection devices industry growth. Following the event, InspireMD penned down an agreement with medical equipment giant Hester Diagnostics Pvt. Ltd, for the distribution of CGuard™ EPS system. Also, in the beginning of the year the product received an approval from India’s Central Drugs Standard Control Organisation.

As the marketplace continues to evolve, regulatory standardization has become much more stringent and obligatory. Despite the fact that regulatory scrutiny is not specific for embolic protection devices industry alone, the impact of these mandatory roll outs in this sector is quite undisputable. Among the few governmental organizations that have implemented notable standards, U.S. FDA tops the list. As a result, renowned giants have been striving hard to enhance their product portfolio, in a bid to receive green signal from FDA.

For instance, Claret Medical’s Sentinel Cerebral Protection System, since FDA clearance in the mid of 2017, has set a new benchmark in U.S. embolic protection devices market. This absolutely groundbreaking system, has become an emerging standard of care for the country’s large cardiovascular disorder patient base. Particularly designed to mitigate the risk of stroke caused due to embolic debris, this filter device is reportedly employed in TAVR (Transcatheter Aortic Heart Valve Replacement) procedures. For the record, it has reduced the risk of stroke by almost 60% post TAVR and has protected almost 5500 patients globally till date. As a part of the controlled roll out, Sentinel CPS has been deployed across 50 U.S. healthcare centers, cite sources.

While industry players seek growth in the coming years, an array of challenges is hindering market growth, pricing pressure being at the pinnacle. Speaking along similar lines, low reimbursement policies for stenting procedures across some of the countries coupled with replacement threat from alternative treatment options are squeezing the profit margin. Despite these intertwined deterring factors, investors are making big bets in business space which is quite evidenced from the incessant product launches and M&A activities. Driven by the rapid pace of innovation in tandem with technological advancements, embolic protection devices industry size is forecast to witness a double digit CAGR of 10% over 2017-2024.