EPD coatings market to witness substantial proceeds from consumer electronics application, APAC to drive the regional landscape

Publisher : Fractovia | Published Date : 2018-06-04Request Sample

Thriving on the cusp of transitional technology trends, electronic protection device coatings market has diversified its application landscape to a mammoth range of domains, consumer electronics being at the helm. Testament of the fact is the 50-55% dominance of consumer electronics sector in EPD coatings industry share in 2017. In an era where portable electronic devices have practically penetrated almost every sector, the business space certainly stands in a position to gain remarkable monetary benefits over the ensuing years.

Speaking of its growth prospect, is prudent to mention that the increasing occurrence of liquid damage on smartphones is undoubtedly one of the pivotal factors that has acted as a catalyst in EPD coatings market expansion. As per reliable estimates, more than 800,000 smartphones get damaged everyday around the world, which ultimately leads up to a valuation of almost USD 90 billion annually. In fact, liquid damage is touted to be the second most prevalent reason that demands a smartphone’s replacement or repairing. Amidst this somewhat distressing scenario, electronic protection devices coating market has conveniently gained a renewed attention over the recent years. Incidentally, this has also prompted established EPD coatings industry giants and various academia to bring forth groundbreaking innovations in the business space.

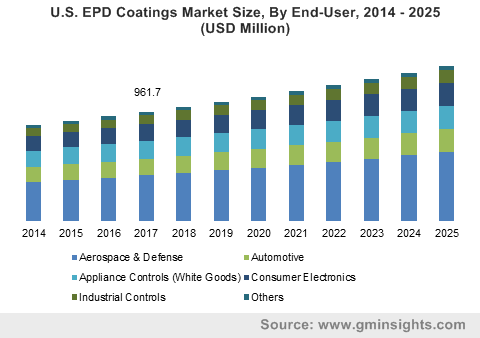

U.S. EPD Coatings Market Size, By End-User, 2014 – 2025 (USD Million)

In this regard, researchers of Suzhou Institute of Nano-Tech and Nano-Bionics (SINANO), the Chinese Academy of Sciences has recently brainstormed a novel piezoresistive and super hydrophobic coating for protecting wearable sensing devices. Reportedly, this extremely flexible multifunctional smart coating is fabricated by spray coated MWCNTS (multiwalled carbon nanotubes) dispersed in cyclohexane and thermoplastic elastomer solution, and finally followed by a treatment with ethanol. These advanced coatings not only ensure water resiliency, but are also claimed to respond better to bending, torsion, stretching. Experts are already raving about the technology, claiming it to be disruptive in the entire electronic protection device coatings industry.

Once being fully commercialized, this multifunctional coating is deemed to amass a huge popularity in flexible sensor sector, as it exhibit properties that absolutely suit sensor applications. Allegedly, this extensive research work has been supported by the Science Foundation for Distinguished Young Scholars of Jiangsu Province, and the National Natural Science Foundation of China. The initiative also brings to light the fact that nanocoating technologies are making a profound headway in electronics protection device industry nowadays.

Speaking of the regional aspect, the Asia Pacific belt has turned out to be a potential hotbed for EPD coatings industry players, primarily influenced by the robust PCB industry growth across these regions. In fact, nearly 80% to 90% of PCB are manufactured in APAC countries like Japan, China, Taiwan, and Singapore. The upsurge in domestic demand for protecting these PCBs has sent out waves of anticipation across EPD coatings manufacturers’ community. Citing an instance, globally acclaimed chemical giant Dow Chemical has recently unveiled its complementary portfolio of advanced release coatings solutions at LABELEXPO Southeast Asia. Dubbed as Dow's Syl-Off™, this latest silicone based release coatings range has been especially brought forth by the company to address APAC’s increasing demand. If repots are to be relied on, Dow has incorporated high performance solvent coating including the likes of Syl-Off™ LTC 750A that are claimed to be exceptional in bonding touchscreen displays of mobile phones. Also, as per the official confirmation, these range of coatings can be also deployed in electronic vehicles, for its improved durability and optical characteristics.

It is quite vividly coherent from such instances that APAC electronic protection device coatings market trends are likely to experience sizable investments by leading coating manufacturers. In addition, availability of cost effective materials and cheap labor cost are two of the complementary factors pushing APAC EPD coatings industry to witness 5% CAGR over 2018-2025.

Considering the aforementioned trends, it would not be incorrect to say that consumers of future would influence electronic protection device coatings industry trends. With automotive electronics becoming more technologically advanced and sophisticated in terms of reliability and functionality, automotive applications has emerged as a lucrative growth ground for the marketplace, both across developed as developing countries. Inherently stimulated by a plethora of transformative trends and the subsequent widening of its application terrain, EPD coatings industry size is forecast to exceed a valuation of USD 20 billion by 2025.