U.S. electric water heaters market to traverse along a lucrative growth map over 2018-2024, surging product deployment across the residential sector to stimulate the global demand

Publisher : Fractovia | Published Date : 2018-10-23Request Sample

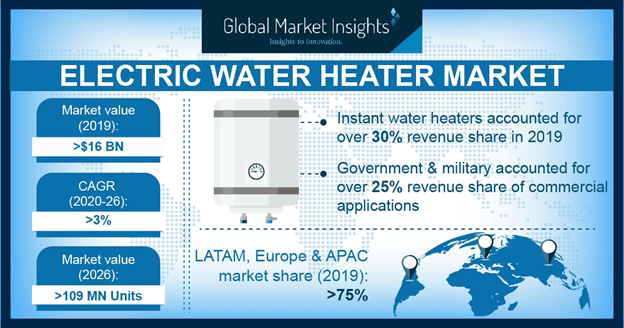

A highly acclaimed vertical in itself, electric water heaters market has received a commendable boost from the exponentially rising awareness regarding limited fuel supply having stimulated the demand for electric-powered alternatives. The growing requirement of electric heaters across the household, medical, and hospitality sectors, on account of the former providing an edge over traditional fuel-based heaters in terms of costs, product design, and shelf life, has led to electric water heaters market gaining substantial proceeds lately. Additionally, these heaters can be efficiently installed pertaining to space conditioning loads and require lesser maintenance, which will propel electric water heaters industry size, pegged at USD 16 billion in 2017.

Europe Electric Water Heater Market Size, By Capacity, 2017 & 2024 (USD Million)

Electric water heaters function on the principle of thermodynamics and are massively utilized across domestic applications such as cleaning, cooking, space heating, and bathing. These heaters are available in a variety of appliances such as heat exchangers, geysers, hot water heaters, hot water tanks, and boilers, many of which are deployed on a large scale across the hospitality, healthcare, and construction sectors. It is thus rather overt that electric water heaters market share from commercial applications will exhibit tremendous growth over the next few years, driven by the surging demand from hotels, medical centers, office buildings, hostels, and academic institutions. Products used in commercial applications need to be lined with stainless steel, hydrastine cement, regular cement, or glass, since they require to exhibit a high rate of durability and efficiency.

Residential applications held a substantial proportion of the electric water heaters market share in 2017. Electric water heaters of high capacity are extensively deployed for applications such as cooking, laundry, and bathing. With the exponential growth of the construction sector, the enforcement of building codes and standards have observed a rise, on the grounds of which electric water heater market from residential applications is expected to grow at a healthy pace in the ensuing years. In addition, evolving consumer lifestyle, rise in the per capita income, the necessity for customer satisfaction, and the constant need for product innovation will augment electric water heaters industry share from residential applications.

A pivotal factor that would augment electric water heaters market from the residential sector is the presence of a supportive regulatory landscape that encourages the deployment of sustainable heating systems in most homes. As advancements in technology continue to depict an upsurge and innovative products offering multiple control and management features come into play, electric water heaters market from residential applications will grow at a substantial pace over 2018-2024.

The U.S. is touted to be one of the most pivotal grounds for electric water heaters market growth, on account of the extreme weather conditions and the subsequently growing need for reliable hot water supply. Indeed, in the year 2017, U.S. electric water heaters market size was pegged at USD 800 million. The nation is also characterized by a stringent regulatory landscape that mandates the installation of highly sustainable heating appliances which would further augment the regional industry. Powered by the growing adoption of space and district heating systems and the refurbishment of existing heating systems, not to mention, the incorporation of advanced digital heating technologies, U.S. electric water heaters market size is expected to surpass the billion-dollar mark by 2024.

Electric water heater market is quite consolidated, with the top three companies contributing to more than 90% of the total share. Companies are focusing on strengthening their regional presence, primarily through R&D activities. Corporations such as Ariston Thermo, Bajaj, AO Smith, Havells, Venus, and Haier have a rather significant share in India electric water heater industry. Likewise, AO Smith, Haier, and Midea Group accumulate a major share in China electric water heaters market. Eemax, General Electric, AO Smith Corporation, Havells, Bradford White Corporation, Zenith, AquaMax, Bosch, Ariston Thermo, and Rheem Manufacturing Company are the key players operating in global electric water heaters industry.

Leading companies are also concentrating on product differentiation to score a competitive edge over their rivals in the business. For instance, as of 2017, Haier Appliances launched a premium electric water heater in India that is integrated with shock-proof technology. This heater can provide protection against electricity issues such as power leakage, earthing, or incorrect wiring. Most other players are also engaged in the manufacturing of products integrated with cutting edge technology, thus fueling global electric water heaters market.

Electric water heaters are designed to eliminate the disadvantages caused due to fuel-fired water heaters. The rising government pressure on companies for reducing carbon footprints have led to major corporations striving to develop low cost, eco-friendly, and efficient electric water heaters. Such strict norms coupled with changing consumer preferences toward electric products are sure to impel global electric water heater industry share over the coming years.