Distribution transformer market to exceed the USD 30 billion mark by 2024, driven by rising grid upgradations in North America and Europe

Publisher : Fractovia | Published Date : 2017-12-22Request Sample

The growth graph of distribution transformer market has been projected to be directly proportional to the exponential rise in electricity demand and supply across the globe. With growing urbanization, the emergence of new power infrastructures and the modernization of aging power infrastructures are indeed inevitable, which would directly impact the expansion of distribution transformer industry. In electronic power dissemination, distribution transformers provide the final voltage transformation and bring the voltage down to the level of customer requirement. With pervasive growth in the residential and commercial sectors, these products will witness growing demand, thus driving distribution transformer market size, estimated to reach over 80,000 units of annual installation by 2024.

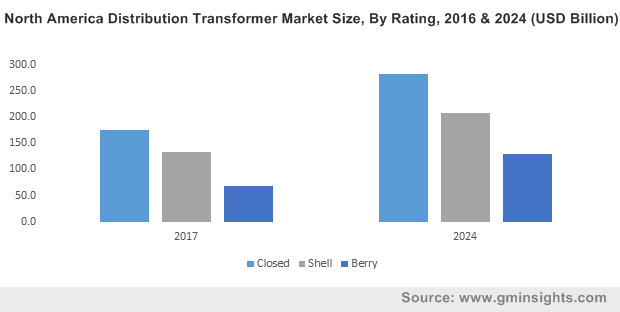

North America Distribution Transformer Market Size, By Rating, 2016 & 2024 (USD Billion)

With the rising awareness about the global energy crisis due to increasing CO2 emissions, numerous governments and regulatory bodies have been looking for means to decrease and control CO2 emissions. Industrial companies account for half of the electricity consumed in Europe. As a means to regulate CO2 emissions from these companies and cut down on power leakage, emphasis is being laid on upgrading industrial grids with distribution transformers. The implementation of distribution transformers in most of the industrial facilities of Europe will thus provide a massive surge to the regional distribution transformer market. European nations have also approved investments amounting to over USD 133.7 billion in 2017 in order to deploy smart grids in the continent. Investments such as the aforementioned and the launch of myriad schemes to install an increasing number of smart grids to increase power efficiency will create a favorable scenario for distribution transformer industry growth. Among the European countries, Germany and Norway have been pivotal contributors toward the regional distribution transformer market, driven by technological innovations and annual installations. Germany distribution transformer market for instance, has been forecast to witness an annual installation of 3,500 units by 2024, while Norway is working towards digitalizing its distribution grids, making them autonomous. Rapid industrial expansion in the region, in tandem with the objective of establishing reliable electricity infrastructure with the expansion of micro grids will create a favorable growth scenario for Europe distribution transformer market.

In 2017, US regulators made a provision of USD 100 million to meet the increasing electricity demand across the rail networks of USA. Such government provisions and appreciable investments from other sectors toward the upgradation of the existing electricity infrastructure and replacement of the present grid network with advanced technology will spur U.S. distribution transformer market share. The U.S. is projected to witness an annual installation of over 7,000 units of distribution transformers by 2024, which would also invariably impact North America distribution transformer industry.

Emerging economies of Asia Pacific have become the largest consumers of electricity due to rapid urbanization and increasing industrialization. The government of India has undertaken a number of schemes in an effort to supply its vast population with electricity. As the country is demanding more reliable power supply, distribution transformer market would witness massive growth in India, and by extension, across the APAC.

The Middle East and Africa have apparently received tremendous support from numerous other economies in meeting the demand for electric power supply. Contributions have been made by institutions like the World Band and African Development Bank to provide Africa with reliable electric supply. In 2017, ABD made a contribution of USD 12 billion towards the African electricity sector. As electricity deployment gains prominence across the African continent, the regional distribution transformer industry is sure to garner profits. North America and Europe have been pioneers as far as energy conservation is concerned, owing to which the growth of distribution transformer market in these regions has been rather prominent.

Distribution transformers are usually 99% efficient at preventing energy loss. However, considering the sheer base of the distribution transformer installations, even a small loss becomes a significant one when the aggregate amount of loss is taken into account. Energy loss ultimately contributes to CO2 emissions and adds to the overall global warming crisis. In this regard, utility regulators and governments are owning up to their commitments and responsibilities towards the environment, in turn striving for the innovation of better technology, thus providing the much-needed impetus to distribution transformer market. Key players in the distribution transformer industry such as Siemens, EATON, Schneider Electric, ABB, General Electric, BHEL and Ruhstrat are increasingly concentrating on the development of technologically advanced distribution transformers that will decrease CO2 emission while increasing the overall energy efficiency. In consequence, this would contribute toward the significant growth of distribution transformer market, thus leading to this business sphere to emerge as one of most pivotal verticals of the energy domain.