Increased deployment of robotics to influence digital oilfield market outlook

Publisher : Fractovia | Published Date : 2019-08-19Request Sample

Major technology developments in automation, data analytics, connectivity and sensing have expanded digital oilfields market share, in conjunction with increased adoption of Internet of Things (IoT) devices in the oil and gas sector. Digital oilfields aim to converge operational technology with information technology in an environment that enables achieving maximized production and lower costs. General awareness regarding the favorable effects of digitalization across oilfields will also help drive industry trends over the forecast period.

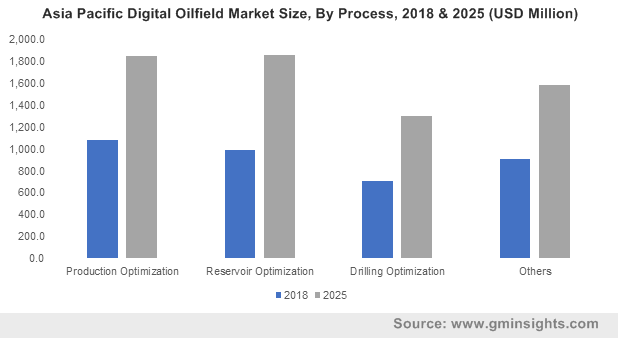

Asia Pacific Digital Oilfield Market Size, By Process, 2018 & 2025 (USD Million)

Digital transformation in the oil & gas sector is capable of bringing tremendous monetary benefits for the society, in terms of savings as well as exploration costs. Several government initiatives to support industrial growth and digitization will help propel digital oilfield industry size. For instance, government of India has permitted 100% Foreign Direct Investment (FDI) in several segments, including petroleum products, refineries and natural gas. Such investments will help in expanding the implementation of innovative connected technologies across oilfields in emerging economies.

Increased use of IoT in the digitization of oil exploration and drilling operations will transform business processes and deliver faster production, which in turn will boost revenues for global digital oilfield market. IoT is going to help generate a value worth in trillions over the next few years, according to the World Economic Forum, which has also stated that the internet revolution will dramatically change the energy sector and provide unprecedented business opportunities.

The efficiency, speed and productivity at connected digital oilfields and in field communication infrastructure can be majorly improved, with the use of lesser capital, by applying modern wireless technologies. Wireless systems segment will be one of the major factors contributing towards digital oilfield industry share, due to consistently emerging products boasting of advanced sensing and connectivity solutions. Taking investment decisions and creating budgets for new projects in relation with oil exploration and deployment of wireless technology in oilfields will considerably bolster the segment growth.

Mounting utilization of robotics in the oil and gas sector is enabling faster delivery of services, with major oil producers like BP and Statoil investing in futuristic oilfields, wherein they hope to replace workers with smart devices. The substitution can save lives, cut costs and reduce scope for error, besides freeing up skilled employees to focus on more critical tasks. For instance, robots have seemingly been deployed to crawl underwater in order to test the subsea equipment for small metal cracks that may go unnoticed by a human eye.

BP has rolled out magnetic crawlers after it piloted a small robot at its Thunder Horse platform near the U.S. Gulf Coast. Magnetic crawlers can move across platforms, pipelines and rigs by using ultrasonic test devices and cameras that are of high definition. Various companies are partnering to expand their reach into digital oilfield market, such as General Electric’s deal with Nobel Drilling for the production of a completely digitalized drilling vessel. Firms have also invested in deploying drones to keep a check on higher floating rigs, while planning to use mini submarines in place of deep sea divers.

According to the U.S. Energy Information Administration (EIA), the revenues of OPEC (Organizations of the Petroleum Exporting Countries) was expected to be valued at $719 billion in 2019, significantly influenced by crude oil prices. Oil companies in these regions have increasingly adopted digitalized solutions to augment their output and returns. Abu Dhabi National Company, Saudi Aramco and Kuwait Oil Company were some key investors in this region. Middle East digital oilfield market will witness a substantial transformation and growth owing to a massive dependency of oil production and trade with other countries.

Major companies like ABB, Rockwell, General electric, Kuwait Oil Company, Accenture, Weatherford and Halliburton are the key market players who are involved in numerous investments and projects that will stimulate the space of digitized oil operations. Reduced cost of technology and the increasing acquisition of enterprises will boost digital oilfield market share, which is projected to surpass annual valuation of USD 39 billion by 2025.