Data center liquid cooling market to derive substantial returns from large data centers, global industry to cross a valuation of $2.5 billion by 2025

Publisher : Fractovia | Published Date : 2019-02-21Request Sample

The global data center liquid cooling market has emerged as a prominent investment ground lately for potential stakeholders, given the increasing workloads, storage densities and computing requirements of organizations worldwide. With servers across data centers becoming more sophisticated, the one major trade-off is the amount of heat they generate during their operation. The matter of overheating becomes a major point of concern when the issue results in a loss in power causing the servers inside the data centers to fail, bringing operations to a halt and costing the organization millions of dollars. This has made efficient & reliable operations of the cooling, power & support systems extremely crucial for ensuring continuous flow of data across these mission-critical facilities, a fact that has served to majorly augment data center liquid cooling market.

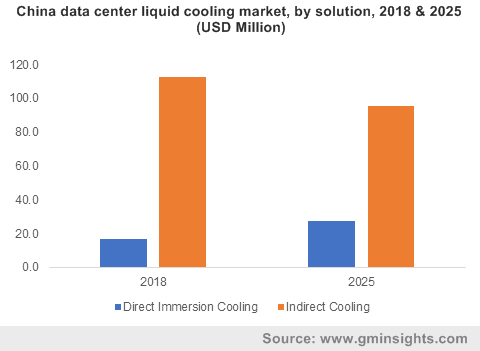

China data center liquid cooling market, by solution, 2018 & 2025 (USD Million)

With the primary intention of reducing the high level of network latency across conventional facilities, a number of edge data centers are emerging throughout the world, which would be further facilitating the industry expansion in the forthcoming years.

Data center liquid cooling industry | Impact of direct immersion cooling solutions

Direct immersion cooling, also known as liquid submersion cooling, is touted to be one of the major component solutions prevalent in the data center cooling market, that entails that the components or the entire server be submerged in a thermally, however not electrically, conductive liquid. The solution has been gaining exceptional traction lately, augmenting data center liquid cooling industry share from direct immersion cooling solutions, owing to its significantly high level of reliability as well as compatibility with both GPUs & CPUs.

The direct immersion cooling solutions also possess the capabilities of cooling solid-state drives, making the complete cooling process extremely efficient when compared to other conventional cooling methods. In fact, according to Fujitsu, as the direct immersion cooling completely eliminates the need of air conditioning for the facility and does not require the servers to have their own individual cooling fans, this type of liquid cooling system could reduce the power consumption by as much as 40% when compared to traditional systems.

Data center liquid cooling market size from direct immersion cooling solutions would also be benefiting from the fact that the component facilitates approximately double the amount of server density within the same installation space, which further contributes to reduction of total cost of ownership (TCO).

Data center liquid cooling industry | Impact of the rising number of large data centers

With a significant number of enterprises across the globe undergoing a digital transformation, the overall data center industry has been experiencing an exponential amount of growth. Moreover, the profit potential for owners of data centers has remained significantly strong over the coming years with margins that are considerably better than the ones that are available for other types of commercial construction, including the ones held by Class-A office space, which has led to the robust prevalence of large data centers globally. As a matter of fact, in 2017 large data centers dominated the overall data center liquid-cooling market with a total revenue share of approximately 75%.

Meanwhile, according to the U.S. Department of Commerce, the meteoric rise of cloud computing has proved to be an extremely crucial growth factor behind the radically increased economic impact and size of data center investments that were made by the world’s four largest service providers, Facebook, Amazon, Microsoft & Google. With major tech behemoths contributing to the upsurge in the number of large data centers, data center liquid cooling market share from large data centers is anticipated to increase in the years ahead.

Large data centers as a matter of fact, have been an industry norm for a while now, however, the industry has seen a recent shift where its appetite for hyperscale datacenters has seen a sudden rise due to their ability of handling large tenants & capturing scale efficiencies. Under this shift, the once considered to be large 150,000 sq. feet data centers are now considered medium sized with 600,000 to 1,000,000 sq. feet facilities now defining the word “large” in the industry.

This hyperscale trend, while proving beneficial for data center market in terms of economic growth makes a massive trade off in terms of heat generation & heat retention, thereby providing the overall data center liquid-cooling market considerable avenues for growth.

These aforementioned trends signify, quite overtly, that the global data center liquid-cooling market has positioned itself in a significantly lucrative spot to attract exponential investments over the coming years. In fact, a report by Global Market Insights, Inc., forecasts that the data center liquid cooling market would be surpassing an overall valuation of more than $2.5 billion by 2025.