Accelerated vitamin E intake to push global Cresols Market growth over 2016-2024, Chemical intermediates to dominate the application landscape

Publisher : Fractovia | Published Date : 2017-06-09Request Sample

With the surging demand for Vitamin E in the animal feed additives and dietary supplements across the world, cresols market is experiencing an escalating commercialization. Consumers sedentary lifestyles and unhealthy food habits leading to fluctuating nutrient content in the body are creating new opportunities for the overall market from the growth perspective. Worldwide, synthetic vitamin E intake is estimated to witness a surge from 100 kilotons to 150 kilotons in a period of 2015-2024. This projection in the consumption trend will leave a proportional impact on cresols market as well. Asia Pacific and Europe is observing a lucrative position in the overall industry, owing to the spreading consumer awareness which has resulted in an increase in nutraceuticals demand in this region. As per a report by Global Market Insights, Inc., “Cresols market is poised to record a valuation of USD 474 million by 2024, with a projected CAGR of 3% over the period of 2015-2024.”

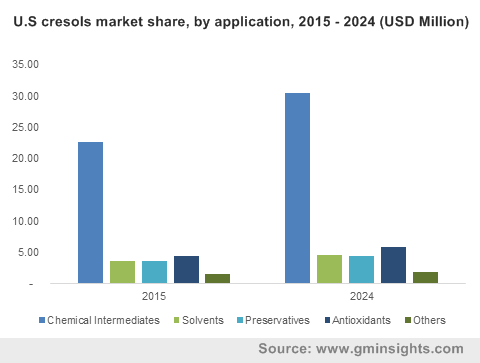

U.S cresols market share, by application, 2015 - 2024 (USD Million)

Taking into consideration the application landscape, cresols market from chemical intermediates application is anticipated to experience maximum gains at an annual rate of 3.5% over the coming seven years. Cresols are extensively used as a chemical intermediate in the production of Vitamin E. As a result, increasing consumption rate of Vitamin E across the world is proportionally impacting on cresols market dynamics as well. Broad application array of Vitamin E in the human dietary supplement, animal feed additive along with considerable growth in the chemical industries over the past few years has substantially increased the overall market demand. Solvent applications also accounted for a notable share in 2015, by collecting a revenue of more than USD 35 million. Polymer industry is the major end use sector that is substantially driving the cresols market from this sector. The industry is also experiencing a huge demand from automotive and electronics sector. Cresols’ unique capability of enduring elevated temperature under mechanical stress with comparatively lesser creep, makes them a good fit for manufacturing of pulleys, natural gas valves, and automotive brake pistons.

Meta cresols, ortho cresols, and para cresols are the three-predominant product thriving the cresols market. Meta cresols are mainly used as a precursor in the production of synthetic vitamin E. It is also commercially used in fenthion and fenitrothion pesticides. In addition to this, increasing meat consumption has further escalated the product demand in animal feed additives industry. In 2015, meta cresols market size was over USD 160 million and is expected to witness substantial growth in the years ahead. Para cresols will continue to be one of significant revenue contributors for the overall cresols industry share owing to the rising demand for the product from pharmaceuticals, rubber, and cosmetic sectors. As per estimates, para cresols market is forecast to register an annual growth rate of more than 3% over 2015-2024.

Regionally, Asia Pacific has a strong ground enhancing the overall cresols market outlook. Changing consumer food habits leading to increasing dietary supplement demand has subsequently escalated the product adoption in this region. With a projection of attaining maximum gains, APAC cresols market is anticipated to record a CAGR of 3.5% over the period of 2015-2024. North America market is also expected to witness a lucrative growth trajectory over the forecast period, having acquired a revenue of USD 45 million in 2015. Strong demand for preservatives in the food packaging sector along with extensive usage of cresols as chemical intermediates across the pharmaceutical industry is catalyzing the industry expansion. U.S is likely to be the major revenue pocket for the regional cresols market.

Mergers & acquisitions, enhanced product portfolio, and heavy R&D investments are the major business strategies implemented by the market players to extend their geographical presence on a global scale. In 2015, the overall cresols industry was highly concentrated with some of the prominent participants accounting for more than 50% of the total share. Henan Hongye Technological Chemical, Atul Ltd, SABIC, Sasol Phenolics, and Lanxess are some of the top-notch companies witnessing a strong foothold in the market.