Construction Sealants Market to witness exceptional proceeds in Asia Pacific belt, India & China to be major revenue pockets

Publisher : Fractovia | Published Date : 2018-01-11Request Sample

Construction Sealants Market has arguably received much of an attention lately than ever in the past few years. Shifting trend toward smart energy saving construction, increasing volume of high rise projects, and governmental implementation of stringent regulations with regards to solvent emissions are some of the major determinants driving the commercialization matrix of construction sealants industry. As claimed by Global Market Insights, Inc. the overall business space which was pegged at USD 4.5 billion in 2016, in all plausibility, would surpass a valuation of USD 6.5 billion by 2024.

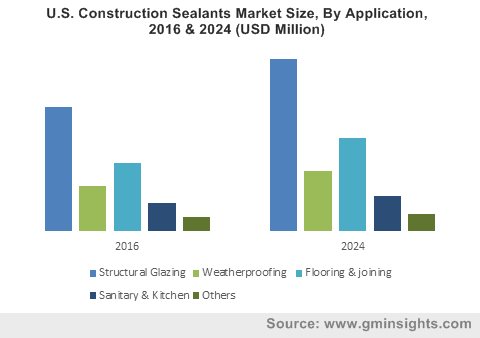

U.S. Construction Sealants Market Size, By Application, 2016 & 2024 (USD Million)

How global economy has affected construction sealants market dynamics?

The overall consumption of sealants in the construction sector is claimed to be inextricably related to global GDP growth. Regardless of whether the nation is emerging or developed, it is no novelty that the construction industry plays an instrumental role in global economic output. Statistics depict- global construction sector represented almost 13% of the overall GDP in the year 2013, and is forecast to account for almost 15% by 2020. Considering the preferential position that sealants have managed to procure in modern construction activities, it is needless to mention that construction sealants market dynamics would also be perpetually influenced by the GDP growth. On a generic note, sealants are basically substances that are used to prevent any kind of fluid leakage through joints or openings in materials. However, in case of building construction, it is synonymous to caulking, as these materials serves plethora of other purposes as well such as blocking sound, dust, most importantly ensure efficient heat transmission. Primarily augmented by this add-on benefits, global construction sealants industry in terms of volume coverage is set to upsurge in the years ahead, with a projected consumption of 700 kilotons by 2024.

APAC to emerge as a major growth ground for construction sealants market

Experts affirm, the growth of construction sealants industry would be substantially high across nations under APAC umbrella, China and India in particular. Testament of the fact is the forecast valuation of the regional industry which is claimed to exceed USD 2.5 billion by 2024. A recent report brought forth by a leading firm on global infrastructure spending outlook claims that with China at the growth front, APAC construction sector would account for almost 60% of the overall infrastructure spending by 2025. In fact, according to some of the trusted official data, the Chinese government is underlining massive construction plans, including the likes of making provision for migrating almost 250 million people to megacities within the next decade. Recently, the country’s infrastructural domain has once again made it to the headlines with the announcement of its upcoming massive aviation project, Beijing Daxing International airport. Tentatively to come onboard by 2019, this latest headline maker is claimed to possess world’s largest airport terminal, and by far, is the biggest constructional project in China. In consequence to such profound constructional activities encompassing the nation, it is indisputable that the regional construction sealants market would also get ample opportunities to flourish in the coming years.

Other than China, India has also proved to be a remunerative avenue for APAC construction sealants market, with a projected y-o-y growth of 6% over 2017-2024. Numerous long term and short term constructional projects both in public as well as private sectors are presently operational in the country. In this regard, it is imperative to mention, as it is observed lately, that the regional construction sealants industry giants have been bending over backwards to establish strategic collaborations, in a bid exploit maximum application opportunity of this marketplace. Say for instance, Pidilite Industries Ltd, one of the most acclaimed Indian sealants maker has recently received board’s approval for acquiring 70% stake in equity shares of CIPY Polyurethanes Pvt. Ltd. Reportedly, through this all-cash deal of ? 96.40 crores , Pidilite is planning to expand its portfolio in construction sealants market from flooring applications.

Regulatory compliances to vividly impact the strategic and competitive landscape of construction sealants market

While construction sealants market giants seek immense growth in the years ahead, a wide array of daunting challenges is expected to hinder the business expansion to some extent, stringent environmental norms implemented worldwide with regards to toxicity and emission levels being at the pinnacle. While the underlying environmental and health benefits of these reforms are hard to ignore, higher cost associated with mandating these compliances as well fluctuating raw material price trends are somewhat deterring small companies from entering the business space. However, on the flip side, the strict regulatory environment is also prompting existing players to make profound investment in R&D activities and product innovation. Renowned giants involved in construction sealants industry, as observed of late, have been increasingly taking proactive approach toward sustainability practices. An apt instance of the aforementioned declaration is the growing popularity of bio-based sealants in the construction domain.

All in all, driven by the growing investment in smart construction project along with a strong positive outlook toward the development of environmentally viable sealants by using soy from renewable resource technology, construction sealants industry is forecast to gain a renewed dynamism with regards to manufacturing processes, product differentiation, and business model in the ensuing years.