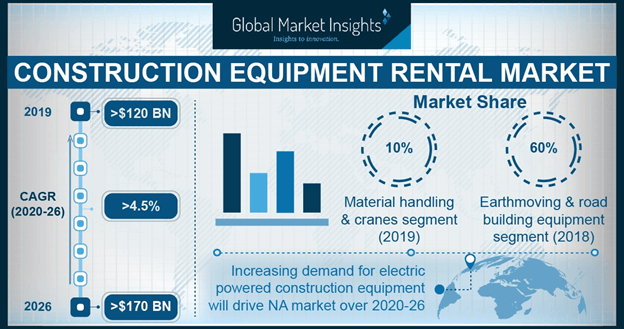

Construction equipment rental market to perceive commendable proceeds via earthmoving and road building equipment demand over 2018-2024, Asia Pacific to emerge as a major revenue pocket

Publisher : Fractovia | Published Date : 2018-08-03Request Sample

A steady rise in the construction activities across the globe has been one of the pivotal factors to drive the construction equipment rental market share. Numerous rental equipment manufacturers have been proactive in incorporating high-grade technical features such as GPS, remote monitoring, and ergonomic controls that has contributed to swift product penetration in the construction sector. Moreover, various governments across the globe are keen to revamp the basic infrastructure in their nations which has led to the launch of enormous infrastructural projects. As a consequence of the aforementioned aspects, the firms operating in the construction equipment rental industry have been presented with humongous business opportunities.

U.S. Construction Equipment Rental Market, By Product, 2017 & 2024 (USD Million)

Owing to a surge in the demand for compaction equipment, loaders, excavators, and backhoes, the product segment of the construction equipment rental industry is being presently dominated by earthmoving and road building equipment. It would be prudent to mention that a steady stream of new earthmoving machines has been spanning the market in the recent times. In addition to this, rapid technological developments have undoubtedly enhanced the working efficiency of the latest road building equipment which has invariably proved advantageous for the construction equipment rental market share.

Speaking along similar lines, several major heavy-equipment manufacturers have been unveiling high-grade excavators which has strengthened the position of earthmoving and road building equipment segment in the overall construction equipment rental industry. Hitachi, for instance, has launched one of the most fuel-efficient excavator in 2017. The ZH210-6 reportedly comes with a new lightweight arm and advanced hydraulics which ensures the excavator consumes less fuel and emit reduced levels of carbon dioxide.

Apparently, it goes without saying that the unveiling of such environment-friendly and highly-efficient machines highlight the technological upgradations being undertaken by construction equipment rental market players in the recent past. As per reliable estimates, the earthmoving and road building equipment apportioned a significant 65% of the total revenue share of the overall industry in the year 2017 and is anticipated to grow at a similar pace in the upcoming years.

The rise of India and China as the foremost nations in the global economy has been touted as one of the most significant economic developments of the 21st century. The persistent growth being witnessed in these nations is certain to dominate the future progression of the world economy over the next few decades. Needless to mention, the construction sector places itself amongst the most crucial business verticals that would not only contribute in building infrastructural capabilities of these nations but is likely to emerge as a noteworthy aspect of economic advancement. In this context, the expansion of construction sector in the major Asian nations is directly proportional to the growth of Asia Pacific construction equipment rental market in the times to come. In fact, as per a research report put together by Global Market Insights, Inc., the remuneration portfolio of the Asia Pacific construction equipment rental industry is estimated to surpass a staggering USD 40 billion by 2024.

With an aim to build a robust foundation for rapid and inclusive economic growth, the prominent Asian economies such as China, India, and Japan have been rolling out massive construction projects, of late, which are set to benefit the construction equipment rental market stakeholders. The Indian government, for instance, has launched an ambitious highways construction program, the Bharatmala Pariyojana, to fulfill the connectivity needs of trade routes, coastal regions, border areas, backward and tribal pockets, places of religious and tourist interest.

Regarded as the second largest highways construction project in the nation since the National Highways Development Plan, the program has a budgetary outlay of INR 8 lakh crore and aims to build 34,800 km of roads in the first phase. Keeping in view the scale of such massive projects, the construction equipment rental industry is set to witness vast business opportunities in the upcoming years. Moreover, India has been deploying enormous resources to set up new international airports, build trade corridors of high-economic activity, upgrade government-owned buildings, revamp the rail infrastructure, and construct huge residential projects to fulfill the needs of housing for a burgeoning population. This would invariably have an optimistic impact on the overall construction equipment rental market in the nation.

The easy availability of fully and semi-automated material handling equipment coupled with rapid adoption of technological advancements by prominent industry players is poised to impel the growth prospects of construction equipment rental market. Driven by rising construction activities across the globe and massive investments being made by several emerging countries to revamp the existing infrastructure, the commercialization scale of construction equipment rental industry is forecast to cross USD 140 billion by the end of 2024.