An outline of centrifugal air compressor market in terms of the initiatives undertaken by stakeholders: advanced technology proliferation to augment the product demand over 2017-2024

Publisher : Fractovia | Published Date : May 2018Request Sample

The competitive landscape of centrifugal air compressor market comprises some of the big shots inclusive of Atlas Copco, Hitachi Industrial Equipment Systems Co Ltd, and General Electric. With high efficiency being the principal focus of energy companies, these magnates have been increasingly striving to develop next-generation compressor technologies for energy-efficient applications. Armed with a similar goal in view, numerous geographies across the globe, to enhance their energy generation capacity, are investing in oil exploration and excavation activities as well as the development of power projects – initiatives that are certain to propel centrifugal air compressor industry. In essence though, it is the rise in energy requirement pertaining to the rapid industrialization across the globe that falls among the pivotal driving factors of this vertical.

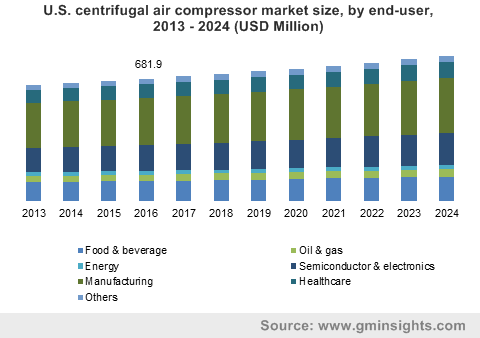

U.S. centrifugal air compressor market size, by end-user, 2013 - 2024 (USD Million)

Speaking about the development of next-generation products, it would be prudent to mention GE’s contribution in the year 2015. GE Oil & Gas back then, launched a new range of advanced centrifugal compressors for several industrial wastewater, air, and gas applications. One of the main advantages of this next-generation centrifugal compressor is its capability to reduce the overall energy consumption of plant. This was specifically important for this site, since the energy consumption from compressors accounted for 60% of the overall plant operation costs earlier.

Considering the cost benefits of newly developed products, many existing plants have been replacing traditional air compression systems with next-generation compressors that do not require to be configured before installation. The ongoing evolution in centrifugal compressor technologies owing to heavy investment in research and development activities is poised to stimulate centrifugal air compressor market size.

Of late, many companies are mainly focusing on the development of customer-centric products for attracting more consumers, enabling them to extend their regional reach. A year before, LG Electronics launched its next-generation magnetic chiller system – an oil-free drive solution for centrifugal compressors in chillers, in the UAE. The UAE government is significantly investing in development of green buildings, taking into account the increasing pollution level due to growing use of air-conditioning and refrigeration systems. This newly developed product will thus be highly lucrative when deployed across the UAE, owing to its energy-saving capability. The shifting trends toward the development of green buildings mainly across Middle East region will also generate lucrative opportunities for the giants in centrifugal air compressor industry.

The growing exploration and excavation activities across the oil and gas sector have also been fueling the demand for centrifugal air compressors. In this regard, many LNG project developers have been signing long-term contracts with product suppliers. A month ago, the Egyptian Electricity Holding Company inked a contract with the Chinese Jiangsu Electric Power Company to carry out the mechanical operations at the West Cairo Power Plant. The Chinese company will be solely responsible for the supply, installation, and supervision of mechanical equipment such as centrifugal pumps, diesel generators, air compressors, and other critical pipe works. Taking cue, other MEA countries have also been calling upon foreign investments in order to develop power generation plants, thereby impelling the regional centrifugal air compressor industry.

Another instance demonstrating the prevalence of the aforementioned strategy is that of GE signing a deal with one of the largest gas producers for the installation of various equipment in 2013. Through this contract, GE provided eighteen centrifugal compressors and other equipment to Russia’s Yamal LNG project. Incidentally, the company already holds a vital stand in Russia. The company has installed 700 hundred compressors, 400 gas turbines, and over 600 number of other equipment across Russia’s oil & gas sector. The escalating involvement of regional governments and product suppliers in energy development projects is slated to boost centrifugal air compressor market size.

Having taken into consideration the escalating demand for compressors across numerous verticals, centrifugal air compressor market players have been vying with one another to take on a leading position in this business space. This has led to the inception of commendable innovations in compressor technology and production. Ingersoll Rand plc for example, a few years ago, acquired the centrifugal compression division of Cameron International Corporation for USD 850 million. Post the takeover, Ingersoll Rand successfully enhanced its compressed air systems business with a wide portfolio of products ranges including centrifugal, reciprocating and rotary air compressors. The deal has also helped Ingersoll Rand to expand its industrial reach mainly across the petrochemical, gas processing, and chemical sectors. Undertaking such growth tactics is certain to help centrifugal air compressor market players augment their stance in this vertical.

The escalating demand for this turbomachinery for a plethora of application sectors spanning industrial to power generation and cleaning operations to transportation is likely to propel centrifugal air compressor market share. Taking into account its widespread application spectrum, technology providers have been working with core companies toward developing next-generation products for attracting more customers. The advent of an advanced product portfolio in centrifugal air compressor industry in the ensuing years is thus likely to stimulate the expansion of this vertical. As per estimates, centrifugal air compressor market size will be pegged at USD 7 billion by 2024.