A quick insight into cell line development market in terms of the competitive scenario: extensive demand for cancer treatments to push the industry growth over 2017-2024

Publisher : Fractovia | Published Date : 2018-06-06Request Sample

The involvement of biopharma companies in clinical, preclinical, and bioprocess development is certain to drive cell line development market. With a majority of the pharmaceutical companies extensively implementing product expansion strategies and accelerating research & development activities, this vertical has already evolved as a niche sphere of the healthcare space. Pharma companies have also been enhancing their software capabilities for improving the performance of myriad biological products. As the prevalence of cancer and chronic diseases continues to surge by the day, major players in cell line development industry have been harnessing automated solutions for developing stable cell lines. Powered by the same, in conjunction with the evolving biological technologies about gene functionality and drug screening, cell line development industry trends are likely to transform over 2017-2024.

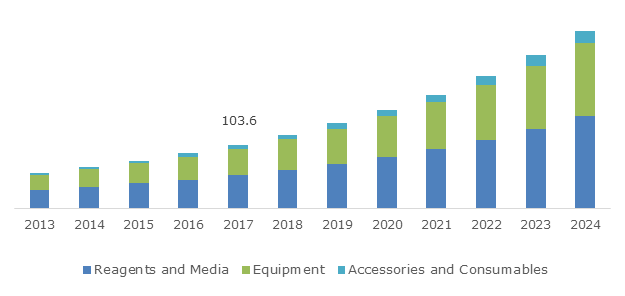

U.S. Cell Line Development Market, By Product, 2013 - 2024 (USD Million)

As far as healthcare regulatory bodies are concerned, it is noteworthy to mention their contribution in the process of product enhancement in cell line development market is indeed appreciable. Validating the abovementioned fact, recently, Pfizer Inc. received approval for its XALKORI (crizotinib) from the U.S. Food and Drug Administration for treating patients with metastatic non-small cell lung cancer. The preliminary clinical evidence for this drug will thus prove useful to demonstrate how further treatments would need to be addressed. With the approval of XALKORI, the FDA has set a new benchmark for the other biopharmaceutical companies partaking in cell line development market share.

Since clone stability is a prominent factor in cell line development, many biotech companies are consistently working to evaluate a new level of subclones. Additionally, they have been working to deploy automated systems to escalate the procedural efficiency, which will ultimately reduce associated costs. In order to accelerate the drug development process, many pharmaceutical companies have also been striving to liaison with each other and work in cooperation. For instance, a few days ago, a renowned company working in digital cell biology, Berkeley Lights, Inc., signed a deal with one of the giants in APAC cell line development market, TPG Biologics, Inc. Together, the two companies aim to carry out collaborative research programs to produce, evaluate, and predict the stability of clones, which can beneficial for validating monoclonality.

Incidentally, TPG already has a streamlined cell line generation platform and has generated a slew of production clones for customers. With TPG’s help, Berkeley Lights is looking forward to attaining a new level of precision and scalability that would not have been possible with semi-automated or completely manual methods. What’s more, through this agreement, Berkeley Lights has taken a step toward expanding its reach across Asia Pacific cell line development industry.

Cell line development market is rampant with frequent partnerships and strategic collaborations that have contributed toward escalating its revenue graph in recent years. Merely a week earlier, the biopharmaceutical company, Bioasis Technologies Inc., teamed up with Wuxi Biologics to develop and manufacture an investigational biological candidate to treat brain cancer. As Bioasis is well-known for its technology platform to treat CNS disorders, this strategic initiative will help both the companies overcome the barriers to treating brain-related diseases. In fact, both the companies are planning to develop sophisticated therapies to become experts in cell line and its formulation development. The aforementioned instance validates that the increasing involvement of biological companies to gain expertise in drug development is poised to propel cell line development market size.

Citing yet another instance, a Germany-based biotechnology company and one of the leading providers of therapeutic glycoproteins and antibodies, ProBioGen AG has set a development milestone to commercialize its cancer cell-killing technology. In this regard, it has partnered with a clinical immune-oncology company, Merus, which will use ProBioGen AG’s GlymaxX® technology to treat various types of cancer. The trend of mutually deploying clinical technologies with rival companies to standardize the conventional treating methodology is likely to push cell line development industry share over the years ahead.

Speaking about the future scenario in cell line development market, it would be prudent to mention that the robust prevalence of JVs and partnerships among biopharmaceutical companies is certain to drive the industry revenue. The growing availability of affordable and clinically effective treatment facilities is likely to enhance product demand, thereby augmenting cell line development industry outlook over the years ahead. By the end of 2024, cell line development market is estimated to collect revenue of more than USD 7.5 billion.