Asia Pacific carboxylic acid market to exhibit the fastest growth rate over 2016-2024, China, Japan, and India to be the lucrative business grounds

Publisher : Fractovia | Published Date : 2017-07-18Request Sample

Characterized by uninterrupted geographical expansions, the competitive landscape of global carboxylic acid market has been forecast to be intensely fierce and aggressive. One of the most recent instances bearing testimony to the aforementioned statement is Oxea’s production facility expansion for propionic acid and butyric acid in Oberhausen, Germany. Recently this year, Oxea upgraded its production facilities for two of its most lucrative industrial acids at the Oberhausen worksite, thereby exhibiting its contribution toward the enhancement of the overall carboxylic acid industry. With this expansion, Oxea has also depicted its commitment toward strengthening its carboxylic acid product portfolio across numerous sectors such as paint & coating adhesives, lubricants, personal care ingredients, and synthetic fluids.

But Oxea obviously isn’t the only firm that is in the running to secure its position in global carboxylic acid market. BASF SE, for instance, had constructed a new formic acid facility with a capacity of 50,000 tons at Geismar, Louisiana for serving its consumers across North & South America, with an aim to consolidate carboxylic acid industry across the aforementioned topographies. On that note, it is important to bear in mind that worldwide carboxylic market is heavily fragmented, with major corporations and SMBs demanding a fair chunk of the global revenue. The top five players of this business space captured lesser than 25% of the overall share in 2015. Key companies locking horns with another to hold a leading share in carboxylic acid industry include LyondellBasell Industries, Dow Chemical Company, BASF SE, Alfa Aesar, Celanese Corporation, Jiangsu Sopo Group, Oxea, Eastman Chemical Company, and Perstorp Holding.

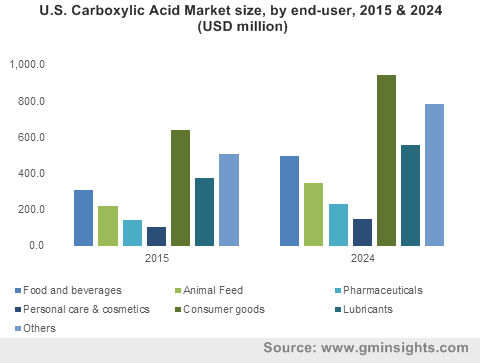

U.S. Carboxylic Acid Market size, by end-user, 2015 & 2024 (USD million)

Carboxylic acid market trends from stearic acid applications

Synthesizing carboxylic acid derivatives obtained from unsaturated carbon compounds is a crucial process that is, as a rule, carried out for making chemicals finding applications across the agrochemicals, cosmetics, pharmaceuticals, and polymer sectors. In an industrial setting, this process is performed with a suitable catalyst and high-pressure carbon monoxide.

Carboxylic acids such as butyric, valeric, and stearic acids are thus, extensively used in the manufacturing processes of soaps, detergents, cosmetics, cleansing agents, and other personal care products. As per statistics, skin care products, hair care products, fragrances, and cosmetics capture more than 80% of the personal care product spectrum. The escalating demand for such products is expected to provide a positive impetus to stearic acid market, which was worth USD 3.5 billion in 2015, having accounted for a share of 25% of the overall carboxylic acid industry. A growing consciousness regarding personal care and hygiene, especially across the Asia Pacific, will lead to a rise in the demand for fragrances, softening and release agents, and soaps. In addition, increasing disposable incomes coupled with rising consumer purchase parity will push carboxylic acid market growth from stearic acid over 2016-2024.

Carboxylic acid industry trends from acetic acid applications

Acetic acid is undeniably one of the most lucrative product segments of carboxylic acid market. In 2015, acetic acid dominated the overall carboxylic acid industry share, with a contribution of more than 40%, and a revenue of more than USD 5.5 billion. The product is massively utilized across the F&B sector for food preservation, vinegar production, and taste enhancement. In addition, researchers at the RIKEN Center for Sustainable Resource Science have recently made a wonderful discovery, that increasing the amount of acetate in plants is bound to help them survive droughts. On these grounds, (AA) acetic acid market is anticipated to exhibit the fastest growth with a CAGR of 5.5% CAGR over 2016-2024.

While the personal care and F&B sectors are the prime end-use domains of carboxylic acid industry, leading companies have been exploring other areas of product utilization that are likely to help them multiply their profit margins. The consumer goods sector is one such lucrative application that recorded more than 35% of the overall carboxylic acid market share in 2015, with a revenue of more than USD 4.5 billion in 2015. The extensive usage of plastic in the construction, agricultural, packaging, and electronics applications necessitates the demand for acetic and stearic acids, pertaining to which carboxylic acid industry from consumer goods is expected to grow at a CAGR of 5% over 2016-2024.

Another vital professional sector that is estimated to increase the targeted revenue of carboxylic acid market is that of animal feed. The utilization potential of formic acid, propionic acid, and other such organic acids in animal feed to prevent the growth of microbes that contaminate the feed and cause health hazards to the animals and humans has been recognized widely in recent times. Naturally, leading business players have been focusing on upgrading their product portfolio in a bid to use these acids increasingly as animal feed additives. Oxea’s production facility upgradation for propionic acid, for instance, supports the growth of animal feed acidifiers that help to develop animal feed devoid of antibiotic growth promoters. In addition, strict regulations with regards to banning antibiotic growth promoters in animal feed for cattle, poultry, and pigs will carve out a positive growth graph for carboxylic acid market from animal feed applications.

The emerging economies of Asia Pacific will prove to be one of the most lucrative business grounds for the growth of carboxylic acid industry. As per estimates, the region accounted for more than 45% of the overall carboxylic acid market share with a revenue of USD 6.5 billion in 2015. This is primarily due to the escalating F&B and consumer goods sectors in the continent. APAC carboxylic acid industry size is estimated to register the fastest growth of 5% over 2016-2024, with the broad application scope of the product across numerous end-use sectors.

Despite boasting of a widespread product and application spectrum, carboxylic acid market has its share of detrimental restraints, one of the primary ones being, the availability of organic substitutes in the animal feed sector. Formic acid, acetic acid, stearic acid, and other such products have reportedly lost their market share to products such as antimicrobials & antioxidants, amino acids, nutraceuticals, and probiotics, in the recent years. The governments of various countries and certain regulatory bodies have also imposed specific restrictions of the production of petroleum-based carboxylic acids encompassing long-chain hydrocarbons, which is likely to restrict carboxylic acid industry growth. Nonetheless, the innumerable product utilization across numerous professional domains is projected to catapult this market to greater heights over the years ahead.