Breastfeeding accessories market to establish its position in the billon-dollar business space by 2024, driven by the contribution of major industry shareholders

Publisher : Fractovia | Published Date : August 2017Request Sample

BelleMa, one of the global leaders in breastfeeding accessories market, has recently announced its partnership with Sunset Healthcare Solutions, one of the top producers and distributors of homecare products. The alliance will enable BelleMa to sell its line of breast pumps to the Durable Medical Equipment (DME) Market via Sunset Healthcare - in effect, the homecare product manufacturer will act as BelleMa’s sales & distribution channel for hospitals, clinics, home care providers, GPOs, and long-term care facilities. The partnership marks an important landmark in breastfeeding accessories industry, depicting its robust expansion across numerous end-uses sectors, by means of varied distribution channels, apart from selling its products through its regular partners – Walmart, Beyond, Amazon, Bed Bath, and Sears.

But BelleMa is not the only breastfeeding accessories market player that is striving to expand its product sales via various means, another rival to undertake similar growth strategies is Aeroflow Breastpumps. This breast pump market leader has recently launched a website in the insurance sphere – it is the first of its kind, and aims to combine insurance processes with e-commerce. The website is slated to feature breast pumps, nipple creams, breast shells, nipple shields, etc., from top breastfeeding accessories industry brands such as Spectra, Evenflo, Medela, and Lansinoh, which can be purchased through chosen insurance coverage plans. Last year, Aeroflow Breastpumps also partnered with Humana and Humana Beginnings that allows it to supply Humana patients with suitable breastfeeding equipment & supplies. Through these initiatives, it is evident that market players will look out for lucrative avenues for expansion through online distribution channels.

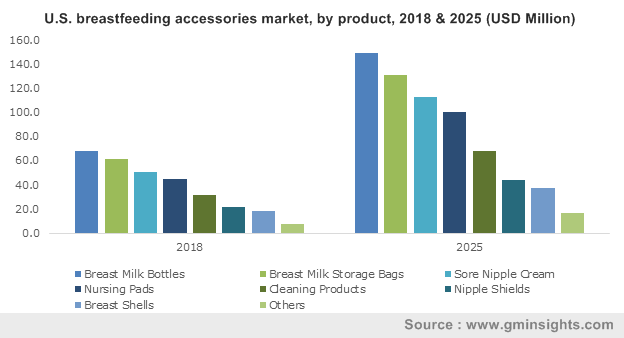

U.S. Breastfeeding Accessories Market size, By Product, 2013-2024 (USD Million)

The Affordable Care Act launched at the onset of 2013 was one of the major regulatory reforms that changed the face of breastfeeding accessories industry. Under this act, it was then mandatory for insurance companies to handle the costs of breast pumps. The act also mandated that employers need to provide sufficient time for female employees who are still breastfeeding their babies. Of late, with the onset of hectic lifestyles and an increase in infant mortality rates, the necessity to breastfeed babies on the job has become a mandate – a factor which, supported by regulatory reforms, will provide a boost to market growth.

As per the Center for Disease Control and Prevention's, 2013 Breast Feeding Report Card, 77% of mothers were breastfeeding their babies, while the 2014 Breastfeeding Report Card depicts that 79% of mothers breastfed their babies after birth. This is a marked improvement from the 71% that was depicted a decade back, and is likely to augment the demand for breastfeeding products, thereby propelling the growth of breastfeeding accessories industry.

Vital statistics pertaining to breastfeeding accessories market:

- As per a recent WHO report, out of 194 analyzed nations, a mere 40% of babies are breastfed as per WHO’s recommendation - for the first six months of life.

- A report compiled in 2015 states that around 14% to 20% of childhood leukemia can be prevented through breastfeeding.

- More than 800,000 children younger than the age of 5 die on an annual basis, due to the lack of breast milk intake.

- Breastfeeding lowers the occurrences of SIDS (sudden infant death syndrome), which accounted for the deaths of around 1,600 infants in the U.S. alone, in 2015.

- The U.S. can save around USD 13 billion per year if nearly 90% of moms exclusively breastfeed their babies for six months.

- Breastfeeding is also likely to prevent around 20,000 breast cancer deaths on an annual basis.

With organizations such as the WHO and the Center for Disease Control and Prevention promoting the benefits of breastfeeding through campaigns and other means, breastfeeding accessories industry size is likely to cross USD 1.4 billion by 2024.

A comprehensive insight into the competitive landscape of breastfeeding accessories market

Lansinoh Laboratories (Pigeon Corporation) – one of the pioneers of breastfeeding accessories industry.

Titled as one of the biggest participants of breastfeeding accessories industry, Pigeon Corp. held more than 21% ROE last year. Currently, the company enjoys a leading business position across myriad geographies. For instance, the company held 70% of Japan’s breastfeeding accessories market from pumping bottles, and around 80% in nursing bottles. Lansinoh Laboratories, Pigeon’s subsidiary, has also been extensively deploying IoT, thereby expanding its product portfolio and consolidating its position in breastfeeding accessories industry.

- Lansinoh recently launched the Lansinoh® Smartpump™ - a double electric breast pump especially designed for busy moms. The product incorporates the Bluetooth technology for the seamless integration of the Lansinoh Baby™ app and the pump and is the first of its kind to be introduced in the market.

- The firm has also launched Lansinoh® Ultimate Protection Nursing Pads that are highly dry & comfortable, in addition to the state-of-the-art Lansinoh® Ultra Soft Disposable Nursing Pads & Lansinoh® Stay Dry Nursing Pads. The products are expected to catapult Lansinoh’s already established position a couple of notches higher.

- The firm’s numero uno selling product - the Lansinoh® Breastmilk Storage Bags, have also been recently redesigned with double-sealed side seams and a double ‘Click’n’ Secure’ tag for leak prevention.

Lansinoh’s robust product landscape is an instance of the immense contribution of the company toward the growth of breastfeeding accessories industry. However, its rival, Medela, is not far behind either, and has fairly consolidated its position in the market over the last few years.

Medela’s growth strategies to sustain its position in breastfeeding accessories industry

- Medela has recently collaborated with Amazon’s Alexa to provide breastfeeding information via the Medela Breastfeeding skill, with the help of which Alexa can answer the most common questions regarding breastfeeding. Collaborating with the world’s most popular retailer will create newer avenues for Medela, especially since now, the Medela Breastfeeding skill is available on the Echo Dot, Amazon Echo, etc.

- In 2016, Medela introduced Sonata, the first smart breast pump, endowed with features that will deliver a reliable, hospital-level performance. The pump seamlessly connects to the MyMedela app and helps to get customized breastfeeding support for moms. In addition, the product demonstrates real-time notifications to charge the breast pump or complete her pump session. The launch of this product has considerably strengthened Medela’s position in breastfeeding accessories market.

- The year 2016 also witnessed Medela partner with Marriott International, as a part of its Medela At Work initiative to encourage breastfeeding mothers to return to work. Through the initiative, the company provided Marriot’s breastfeeding moms, with access to its range of multi-user, hospital-grade breastfeeding accessories. In effect, Medela aimed to expand its consumer base and strengthen its position in breastfeeding accessories industry through this partnership.

Global initiatives related to increasing the breastfeeding rate have slowly made their mark – this has been evident from the slow but gradual rise in the percentage of breastfeeding moms. Major organizations that have been responsible for this increased awareness include the International Code of Marketing of Breast-milk Substitutes, the UNICEF Baby Friendly Initiative, and the Innocenti Declaration. Additionally, WHO’s Global Strategy for Infant and Young Child Feeding can be enormously credited to the rise in breastfeeding rates, which have unquestionably made a positive mark on global breastfeeding accessories market. However, even now, lesser than 40% babies across the world are privileged enough to experience six months of exclusive breastfeeding. In the United Kingdom, this number dwindles down to a shocking 1%. Pertaining to the same, numerous other government initiatives are being launched to monitor breastfeeding policies, such as the World Breastfeeding Trends Initiative (WBTi) launched in 2005. WBTi was introduced by the International Baby Food Action Network assess vital breastfeeding programs, and currently involves the participation of 82 countries. Supported by a stringent regulatory framework, breastfeeding accessories market is projected to expand at a rate of 10% over 2017-2024, and is slated to establish its position among the most lucrative markets of all time.