U.S. to lead global blood preparation market landscape over 2016-2024, Thrombocytosis applications to fuel the regional demand

Publisher : Fractovia | Published Date : 2017-07-05Request Sample

Blood preparation market is poised to be one of the most profound sectors in the healthcare space having already attained a commendable industry valuation of USD 44 billion in 2015. Robust technological development which has become the root of the medical fraternity is one of the prominent factors stimulating blood preparation industry trends globally. The concept of blood preparation was initially introduced in 1960 when the centrifugation of the blood was carried by means of a specialized equipment dubbed refrigerated centrifuge. Since then, driven by the increasing prevalence of surgical procedures and demand from casualties, Blood preparation market has been witnessing an escalated global commercialization.

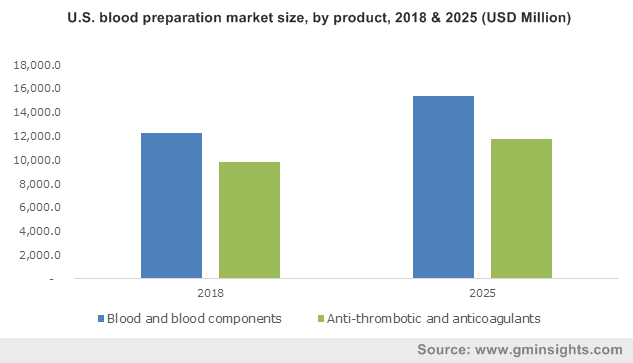

U.S. Blood Preparation Market Size, by Product, 2012- 2024 (USD Million)

As per WHO’s statistics, approximately 112.5 million blood donations are collected across the world, per year. The major origin of this volume is from high-income countries which account for nearly 50% of the total collection. The blood can be transfused to the patient in either an unmodified state or can be utilized more efficiently by processing it into components such as platelet concentrates, red cell concentrates, cryoprecipitate, and plasma. In the latter scenario, the sample can be utilized by more than one patient. However, the former known as ‘Whole Blood’ dominated the product landscape of the blood preparation industry by contributing to 48% of the overall volume in 2015. This was followed by the second most popular product- blood derivatives which held 34% of the global blood preparation market share in the same year.

Blood components is another product segment of the blood preparation market slated to witness a strong growth over the coming years. This product category encountered a comparatively moderate growth than its counterparts, owing to its lesser degree of penetration across the low-income countries.

Below is the percentage of blood processed into components based on the regions and their respective fiscal status, Credits- WHO:

- Low-income countries- 50% of the collected blood undergoes separation into components

- Lower-middle-income countries - 59% of the collected blood undergoes separation into components

- Upper-middle-income countries - 92% of the collected blood undergoes separation into components

- High-income countries- 97% of the collected blood undergoes separation into components

Research also depicts the differences in the transfused patient base category and the applications relevant to the different geographies, which impacts the overall blood preparation industry dynamics. For instance, in high-income countries, the transfused patient base majorly falls in the category of geriatric population accounting for over 76% of the overall transfusion. The transfusions in these regions are mostly carried out for cardiovascular surgeries, massive trauma, transplant surgeries, and hematological disorders. On these grounds, the U.S. will lead blood preparation industry having registered a massive revenue of USD 19 billion in 2015. The region is forecast to record a growth rate of 3.5% over 2016-2024. Supportive regulatory framework across the U.S. is also a leading factor driving the regional demand. For instance, FDA monitors the collection, storage, and transport of blood and works in partnership with health insurance agencies to implement optimal reimbursement for blood components.

As per CDC, 1-2 of every 1000 people in the U.S. are detected with DVT (Deep Brain Thrombosis) or PE (Pulmonary Embolism) annually. As per the estimates, the two aforementioned ailments are listed as the leading causes of demises and dominated the application landscape of the blood preparation market in 2015. Reportedly, Thrombocytosis and Pulmonary Embolism together accounted for 43% of the overall blood preparation industry size in 2015.

The top-notch companies engaged in this business space including- Pfizer, AstraZeneca, GlaxoSmithKline, Leo Pharma, Sanofi, Celgene, Bristol-Myers, and Baxter Healthcare are constantly making efforts to diversify their products and services in sync with the fast-paced technological developments and the demand of the increasing patient base. The companies are investing heavily in R&D to develop novel, efficient, and affordable anticoagulants and antithrombotic drugs. In 2015, anticoagulants led the blood preparation industry landscape holding a revenue of USD 17 billion.

The robust investments in healthcare infrastructure development will further lead to a remarkable expansion of blood preparation market in Europe and Asia Pacific. Europe market share is claimed to be prominently driven by France and Germany, slated to register CAGR of 2.3% and 1.8% respectively. APAC blood preparation industry will also witness substantial growth over the coming years driven by the favorable health norms and technological advancements in healthcare across this region. China, India, and Japan are slated to be the chief revenue pockets for APAC. As per estimates, Japan blood preparation market will register an annual growth rate of 5.9% over 2016-2024.

Over the years, blood preparation industry might certain face growth challenges pertaining to the disease transmission risks such as HIV, Hepatitis B and C, AIDS, and Syphilis pertaining to the blood transfusion process. However, the aggressive efforts by the industry players to develop advanced and safe blood testing technologies will certainly create a profitable roadmap for the overall marketplace. Global Market Insights, Inc. projects the global blood preparation market to surpass a valuation of USD 64 billion by 2024.