Blockchain technology market to accrue substantial proceeds from the BFSI sector, global industry to register an exponential CAGR of 75% over 2018-2024

Publisher : Fractovia | Published Date : 2018-11-27Request Sample

The global blockchain technology market has emerged as one of the most profitable business avenues in the last few years owing to the new technology’s numerous benefits including increased efficiency and speed of transactions, improved traceability, enhanced security, and greater transparency. Blockchain technology has disrupted and transformed various business verticals along the likes of transportation and logistics, media and entertainment, IT services, healthcare, and most importantly, the BFSI sector. Remarkably, the well-known technology giants across the globe appear keen to deploy blockchain technology at their workplaces due to its ability to reduce infrastructure cost and ease of digital information sharing. The need to eliminate slow, complicated, and paper-heavy procedures has proved instrumental in proliferating the commercialization potential of the overall blockchain technology industry in the recent past.

UK Blockchain Market Share, By End-use, 2017

How increasing investment by venture capital firms in blockchain technology startups is driving the blockchain technology industry trends

The traditional venture capital companies are playing a crucial role in funding the development of blockchain technology infrastructure across the world. After realizing the outstanding potential of blockchain technology to disrupt the conventional business models, venture capital firms have adopted different operating procedures and strategies to gain a strong foothold in the blockchain technology market. Enumerated below are a few instances that highlight the significance of venture capital funding in the development of blockchain technology:

- The Florida-based Global Blockchain technology Ventures, LLC has recently launched an ambitious blockchain technology technology-focused venture capital fund worth USD 100 million to fuel innovation distributed ledger technology. The fund further aims to assist the most promising and transformational projects with the capacity to offer practical blockchain technology-enabled applications to benefit the State of Florida.

- Following its participation in the USD 100 million funding of the cryptocurrency brokerage eToro, South Korea’s foremost venture capital funds Korea Investment Partners (KIP) has recently invested in blockchain technology startup Temco. It is being said that Temco intends to implement the proof-of-work (PoW) protocol and find a robust solution for the disorganized nature of existing supply chain management systems by utilizing blockchain technology.

- The blockchain technology-based social network Minds has raised a total of USD 7.4 million by venture capital firms in October 2018. The startup recently released its crypto token exchange that would be integrating securely distributed ledgers with traditional market procedures to enhance auditability, efficiency, transparency, and reduce settlement times and expenses – a phenomenon which is being widely discussed in the global blockchain technology market.

One of the major trends visible in the overall functionality of the world’s largest financial institutions is the favorable results being obtained by deploying blockchain technology, essentially boosting the blockchain technology industry share. Leveraging the capabilities of the technology to compete with the fintech startups, identify new business prospects, and cut down operating costs, prominent banks are incorporating blockchain technology on a priority basis. Bank of England, for instance, intends to restructure the system that underpins the banking operations of the nation by 2020 and fortify defenses against cyber threats by utilizing distributed ledger technology.

In another instance, the State Bank of India has recently declared that it would deploy blockchain technology in its trade finance, remittances, and reconciliation operations by the next financial year. The initiative is in line with a consortium, named Bankchain, formed in 2017 to develop blockchain technology-powered solutions for banking operations in India.

Considering the aforementioned instances, it is quite imperative to mention that the BFSI sector has taken a substantial lead when it comes to exploring the potential of the distributed ledger technology. In fact, as per a research report put together by Global Market Insights, Inc., the BFSI sector apportioned more than 60 percent of the total revenue share of the blockchain technology industry in the year 2017.

In addition to securing financial transactions, blockchain technology is being increasingly viewed by various governments as a facilitator that would speed up innovation and economic growth. Reinforcing its leadership position in the blockchain technology industry, South Korea announced in August 2018 that it would invest approximately USD 4.4 billion in blockchain technology and formulate different administrative frameworks for the distributed ledger systems.

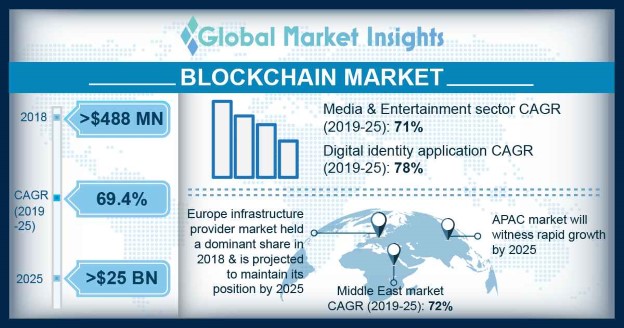

Indeed, the rapid adoption of blockchain technology across a multitude of business verticals would invariably propel the remuneration portfolio of blockchain technology market in the years ahead. Driven by the rising investment by venture capital firms to find effective strategies of deploying distributed technology in various walks of life along with increasing acceptance by numerous governments, blockchain technology market is slated to garner a revenue of over USD 16 billion by 2024.