Private blockchain technology in energy market to derive extensive proceeds by 2025, oil and gas sector to be the one of the most profitable application segments of the industry

Publisher : Fractovia | Published Date : 2019-05-06Request Sample

The global blockchain technology in energy market is garnering increased traction in the recent years owing to the growing number of programs aimed at the digital transformation of conventional power utilities and the rising prominence of renewable energy sources. Providing higher security measures, faster transactions, lower cost operations, and simple governance structure than the public blockchains, the private blockchains are being increasingly preferred by enterprises and energy corporations. In fact, as per a research report by Global Market Insights, Inc., the private category of the blockchain technology in energy industry is slated to register 45 percent annual growth rate by the year 2025.

Germany Blockchain in Energy Market Size, By Power Application, 2018 & 2025 (USD Million)

The technology is offering a new level of sophistication to energy suppliers which have previously relied heavily on highly centralized systems. With potential opportunities being endless, numerous blockchain start-ups have cropped up to pioneer the use of blockchain within established energy markets. Enumerated below are a few instances of startups using blockchain in innovative ways to enhance energy systems:

- Blockchain-based green trading startup WePower has unveiled a transparent platform on which consumers can monitor energy prices and adapt and diversify their energy portfolio based on the information. The startup has also teamed up with an independent provider in Estonia to give consumers a chance to buy into its program using its own cryptocurrency.

- Australian blockchain startup Power Ledger has built microgrids that have linked new residential developments and clean energy producers. It provides a platform for peer-to-peer trading which also monitors energy generation, its sources and prices. As Australia’s power sector is entering a renewable energy boom, platforms like Power Ledger are revolutionizing the blockchain technology in energy industry trends.

A brief overview of how the oil and gas sector is emerging as the major application segment driving the blockchain technology in energy industry expansion

Often characterized as a lumbering behemoth opposed to change or innovation in favor of a more conventional manner of operations, the global oil and gas sector has certainly not been immune to the after-effects of the enormous technological disruption and upheaval since the industrial revolution.?Over the recent years, prominent oil and gas companies appear to have sidelined the traditional ways of doing business and seem eager to incorporate new technologies that improve efficiency and profitability.

In fact, when it comes to energy trading system, distributed ledger technology stands out as one of the most beneficial technologies for the oil and gas sector. The implementation of this technology in an industry of such global reach and complexity has reduced the costs associated with securing, maintaining, and updating a proprietary trading system. For instance, BTL Group – an enterprise blockchain firm – has recently completed a pilot with major oil and gas giants along the likes of BP, ENI, and Wien Energie. Notably, this pilot has effectively shown that the usage of blockchain technology would not only facilitate gas trades but also has the capacity to reduce the overall expenses by 30 to 40 percent.

Additionally, it would be prudent to take note of the fact that oil and gas companies have struggled through record production levels and high price volatility in the last few years, which has invariably led to massive layoffs, cost-cutting efforts, and less number of new exploration plans. To effectively tackle these challenges, oil and gas corporations are embracing the blockchain technology as they rethink of unique strategies to enhance transaction processing and daily operations. Moreover, oil & gas companies can leverage blockchain to eliminate security risks associated with document mailing, improve trade accuracy, and speed up access to data, along with making invoice processing more efficient. Needless to mention, oil and gas sector is now emerging as one of the major revenue contributors to the global blockchain technology in energy industry.

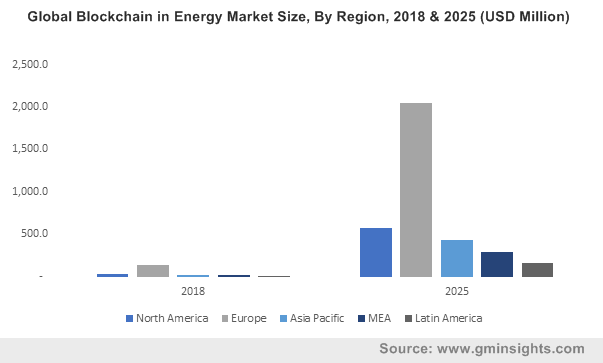

Blockchain technology is gradually acquiring the recognition as a smart contract facilitator and is outgrowing its adolescent cryptocurrency identity of distributed consensus ledgers. It is allowing companies across various business verticals to control data transparency, increase optimization, reduce waste, and improve cost. With the world swiftly moving toward renewable energy sources, the usage of blockchain in the overall power generation and distribution sector is set to increase exponentially in the forthcoming years. Thriving on the backdrop of a robust startup scene along with growing prominence in the oil and gas sector, the commercialization scale of the blockchain technology in energy market is slated to surpass USD 3 billion by 2025.