Biopolymer films market revenue to increase two-fold by 2024, Asia Pacific likely to dominate the regional landscape

Publisher : Fractovia | Published Date : 2017-05-22Request Sample

Escalating growth of the F&B sector subject to the global demand for food and increased consumer spending is expected to fuel Biopolymer Films Market. These films are basically derived from bio-based products and possess the properties of biodegradability and eco-friendliness. Used extensively for packaging across the personal care, domestic products, healthcare, and food & beverage sectors, these films are massively popular, subject to their properties of bio compatibility and negligible toxicity. In addition, the government has introduced strict norms toward environmental friendly packaging, which has prompted packaging manufacturers to deploy these films to package food, medical, and personal care products, thereby propelling biopolymer films industry size.

Consumer spending has observed a remarkable increase in the last half a decade, pertaining to the rising disposable incomes of the population across the world, owing to which product sales across the F&B and personal care sectors has observed an upsurge. On these grounds, biopolymer films market, having had a valuation of USD 3 billion in 2015, is anticipated to cross a revenue of USD 6 billion by 2024, growing at a rate of 7% over 2016-2024,

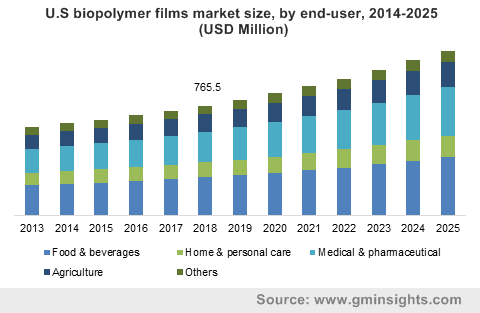

U.S biopolymer films market size, by end-user, 2013-2024 (USD Million)

Major companies operating in global biopolymer films industry include Toray Industries, BioBag International, BASF, NatureWorks, Avery Dennison, Amcor, Innovia Films, Braskem, Klöckner Pentaplast, Taghleef Industries Inc., Evonik Industries, Mondi Group, Plastic Union, and Industria Termoplastica Pavese. Being highly fragmented, biopolymer films market is renown to include the presence of small and medium sized enterprises and large corporations, both of which strive to develop a unique range of products and expand their business space globally. Recently, at the Interpack 2017, which is a rather important fair that exhibits the developments in the packaging sector, held in Dusseldorf, leading corporations such as Mondi, Schreiner MediPharm, Amcor, and BASF displayed their latest innovative packaging products. Recurrent innovations like these is sure to generate lucrative growth avenues for biopolymer films market.

Multilayer film technology led the technology landscape of biopolymer films industry in 2015 by accounting for around 50% of the total share, as this technology based film is highly moisture resistant, has a strong barrier, and a strong seal ability. Subject to its properties, multilayer film based biopolymer films market will gain remarkable revenue over 2016, with massive usage for dry fruit, nuts, spices, and snack packaging.

Another advanced technology used to manufacture biopolymer films includes ALD (atomic layer deposition). This technology encompasses a deposition process that takes place via solid reactions, layer on layer. ALD based biopolymer films market is set to grow at a rate of 5.5% over 2016-2024, pertaining to its ability to enhance the microbial and water vapor barrier properties of PHB and PLA films.

Speaking of which, PLA products held more than 25% of the overall biopolymer films industry with a valuation of USD 800 million in 2015, owing to their applications across the food packaging and agricultural sectors. The huge growth of the aforementioned sectors will further impel PLA biopolymer films market share.

Similar to PLA products, PHB based films also find extensive usage in the F&B sector. These films possess characteristics such as biodegradability and non-toxicity, subject to which PHB biopolymer films industry is likely to generate a CAGR of 5% over 2016-2024.

The food & beverage sector is one of the most lucrative and foremost application sectors of biopolymer films market. Global F&B industry size was around USD 8 trillion in 2005, and increased to roughly about USD 15 trillion in 2015. Subject to rising global demand for food, increased consumer spending on packaged meals, changing consumer lifestyles, and government norms regarding bio based food packaging, the food & beverage sector is predicted to grow at a rate of 8% over the next few years. This growth with undoubtedly expedite biopolymer films market share from food packaging applications.

Food & beverages dominated the end-use segment of biopolymer films market by accounting for over 35% of the overall share in 2015. Of late, a hectic and sedentary lifestyle has increased the consumer demand for packaged food. Additionally, strict legislations regarding bio based packaging and increased consumer spending will boost biopolymer films industry size from food & beverage applications, especially across the geographies of Asia Pacific and North America.

Pertaining to the stringent government regulations regarding the importance of biodegradable packaging, North America accounted for more than 25% of the global biopolymer films market share in 2015, with a valuation of USD 800 million. With U.S. at the helm, North America biopolymer films industry is expected to register a notable growth rate over the next seven years. This growth potential can be credited to the increasing development of the F&B sector, increased product demand, and the prevalence of strict legislations by organizations such as REACH and EPA.

Asia Pacific, led by China and India, is anticipated to the region exhibiting the highest growth rate over 2016-2024, particularly due to the high demand for biodegradable healthcare and food packaging. Subject to the changing consumer trends toward packaged food consumption, increasing disposable incomes, and awareness regarding the importance of bio based packaging will propel APAC biopolymer films market, which is likely to lead the global market over 2016-2024.

Biopolymer films are manufactured with raw materials that are partially bio based, completely bio-based, synthetic, and microbial synthesized. Bio based biopolymer films industry, in particular, will register a CAGR of 6% over 2016-2024, subject to their superior properties. These materials are available in varied range such as starch, protein, cellulose, and pectin. The huge growth of chitosan market, driven by the rising popularity of bio based materials, will also suitably impel the overall biopolymer films market.

Biopolymer films are undeniably advantageous for numerous end-use sectors; however, the product is comparatively more expensive than its synthetic and semi-synthetic counterparts, a factor which is likely to hamper biopolymer films industry share. Nonetheless, market players have been investing in R&D activities and engaging in strategic collaborations to improvise the product offering and expand their global presence. In addition, technological advancements have helped companies come up with a range of products with unique properties, which is likely to generate new growth prospects for biopolymer films market.