U.S. bench-top dental autoclaves market to garner appreciable gains over 2016-2023, driven by mandatory government guidelines

Publisher : Fractovia | Published Date : 2017-09-14Request Sample

Bench-top dental autoclaves industry has garnered the reputation of being one of the most intense regulatory-driven fraternities, given the importance of hygiene and sterilization in medical equipment usage. Regulatory norms enforced by the European CE and the U.S. FDA stand to strictly monitor device performance post approval, which has led to important bench-top autoclaves market players such as Tuttnauer experimenting with various steam sterilizers as per end-use demand and transformative product trends. It is very important to bear in mind the fact that bench-top dental autoclaves industry giants have to be legally certified from the regional regulatory bodies to pursue autoclave manufacturing. North America bench-top dental autoclaves industry players, for instance, are certified by The American Society of Mechanical Engineering (ASME), along with its B&PVC (Boiler and Pressure Vessel Code), that have been in use for almost a century now.

Europe Bench-top Dental Autoclaves Market size, by Product, 2012 - 2023 (USD Million)

A crucial factor that is contributing toward the generation of a profitable growth path for bench-top dental autoclaves industry is the rapidly increasing prevalence of dental disorders. As per WHO estimates, half a decade back, almost 100% of adults and 60% to 90% of school going children were diagnosed with dental cavities. Around 15% to 20% of adults between 35 to 44 years of age suffered from severe periodontal disease. These statistics affirm that the rising incidences of oral disorders would be a pivotal determinant that would lead to increased demand for bench-top dental autoclaves industry.

Regional governments have been brainstorming awareness programs to educate the masses regarding the importance of sterilization and hygiene, which would undeniably provide a positive impetus to bench-top dental autoclaves market. The 2014 partnership between Colgate and BDA for raising awareness about dental hygiene among children is an instance of the aforementioned fact.

A crisp insight into U.S. bench-top dental autoclaves market

The U.S., as on 2017, has been forecast to be one of most lucrative regions for the development of bench-top dental autoclaves industry, essentially due to the surging demand for dental procedures that is anticipated to surge in the forthcoming years. According to the information released by the CDC, in 2015, close to 85% of children between 2-17 years of age, 64% of the population between 18-64, and approximately 63% of the populace beyond the age of 65 had a dental visit. These visits were apparently inclusive of routine dental procedures such as root canals, dental fillings, dental crowns, oral & maxillofacial procedures, bridges, and periodontal treatments, which subsequently provided a commendable boost to U.S. bench-top dental autoclaves market. These estimates are also an evidence of the fact that the region is driven by the extensive surge in the number of dental procedures, on the basis of which U.S. bench-top dental autoclaves market size was pegged at USD 20.6 million in the year 2015, having held more than 80% of North America bench-top dental autoclaves market share.

As per the CDC, more than 1.6 million hospital-acquired infections occur in the U.S. hospitals annually, which result in the deaths of close to 99,000 people, not to mention, an estimated USD 20 billion in medical care costs. Considering the gravity of the situation, the U.S. government has been undertaking tactile efforts to increase the rate of steam sterilizer deployment in hospitals to prevent the occurrence of HAIs and provide a boost to U.S. bench-top dental autoclaves industry. The Comprehensive Dental Reform Act of 2012 was one of the many initiatives undertaken by the U.S. government to influence the sales of dental equipment and gradually make a sizable impact on U.S. bench-top dental autoclaves market.

Tuttnauer – Reshaping the competitive landscape of U.S. bench-top dental autoclaves industry

Tuttnauer is one of leaders staunchly ruling the competitive spectrum of U.S. bench-top dental autoclaves market. This comes as no surprise, given that the company is ASME as well as PED certified. ASME in fact, has empowered Tuttnauer to manufacture S-stamped and U-stamped autoclaves, steam generators, and power boilers. The company’s manufactured autoclaves are registered and authorized by the NB (National Board), making them one of most preferred, reliable, and highly efficient products in U.S. bench-top dental autoclaves market.

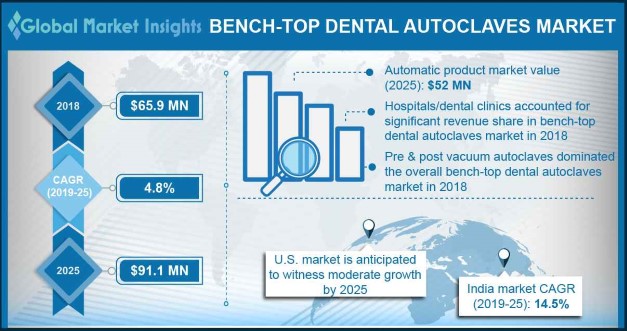

Inherently influenced by the ongoing trends of automation, the dental fraternity has of late, been witnessing a rapid shift toward automated equipment. Pertaining to a meteoric rise in the number of dental procedures and the critical need to reduce error margins, dentists have been depicting an incline toward automated devices. The fact that such devices provide excellent results in lesser time with minimum human intervention is likely to augment automatic bench-top dental autoclaves market size, slated to cross USD 28 million by 2023.

Notwithstanding the numerous product innovations that characterize the competitive landscape of bench-top dental autoclaves industry, this business sphere is anticipated to still be highly driven by regulations formulated by pivotal organizations. Not to mention, even regional governments have been undertaking efforts to prevent the incidences of hospital-acquired infections through sterilization, which is certain to augment bench-top dental autoclaves market share. With increased governmental attempts to impel the sales of dental equipment and consumables, bench-top dental autoclaves industry has been projected to exceed a valuation of USD 78 million by 2023.