Baobab ingredient market to gain momentum from food and beverage applications, global industry valuation to cross $5 billion by 2024

Publisher : Fractovia | Published Date : 2018-10-25Request Sample

Owing to increasing awareness and demand for superfoods, new growth dimensions have been added to industries such as baobab ingredient market that has witnessed a sharp incline due to the nutrient rich profile of the fruit having come to light. The African population has traditionally used baobab to relieve symptoms of dysentery, diarrhea and constipation but the western world has come to assign the status of a superfruit to baobab rather recently. This is essentially because the product has been shown to contain 6 times the vitamin C of oranges, 10 times the fiber of apples, twice the calcium of milk, 5 times the magnesium of avocados and 4 four times the potassium of bananas.

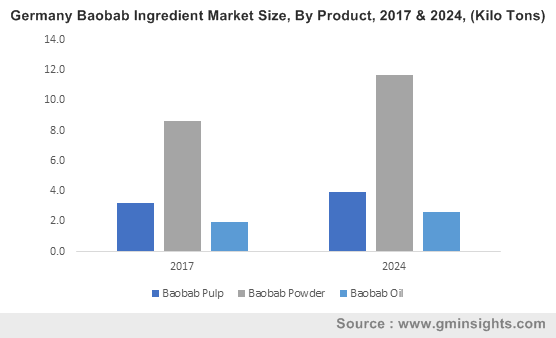

Germany Baobab Ingredient Market Size, By Product, 2017 & 2024, (Kilo Tons)

In other words, baobab is taking the health food industry by storm with its manifold health offerings and overtaking the market from blueberries, açai and goji berries. With research showing that baobab fruit may reduce glycemic response and starch digestion in humans, baobab has been soaring in demand, adding significant impetus to the baobab ingredient market.

The European Union approved imports of baobab in 2008 but being hit by a credit crunch people did not show much interest in the superfruit from Africa at that time and the baobab ingredient market almost went into a hiatus for five years. But with improving economy, that is poised to return to pre-2008 era, interest in superfoods is at an all-time high and with producers and retailers pushing to make baobab famous, baobab ingredient industry has received renewed momentum.

During the new year in 2018, Yeo Valley, a notable dairy company in UK launched its baobab and vanilla yogurt in Britain’s biggest supermarkets while Costco introduced a breakfast bowl with baobab and acai. Back in 2016 Coca-Cola has launched a soft drink called Aquarius Vive which included zinc, vitamin B3 and baobab extract and was developed for the Spanish market as a low-calorie beverage as well as a baobab smoothie called Innocent. With such huge corporations depicting interest in incorporating baobab ingredients in their products, baobab ingredients market size was pegged at $3.5 billion in 2017.

Baobab ingredient market has received an added growth scope through the fact that the tangy tasting baobab powder can be easily integrated into various health foods ranging from granolas to cereals and even fruit juices and frozen desserts. Due to its elevated level of acid, baobab ingredients can be used to bring peripheral flavors into focus, adding brightness and enhancing the end product. Incidentally, baobab has become one of the most highly sought-after ingredients in the beverage industry as it is not only a low-glycemic food but also gluten-free and highly alkalizing, all of which are trending in terms of beverage innovation. It also has a cost-effective perspective adding to its popularity. For instance, in the U.S., adding 50g of baobab powder to single-strength juice costs less than 75 cents per gallon. This addition delivers an incredible 70,000 ORAC units of antioxidants, 1,135mg of potassium, 25g of fiber and 85mg of magnesium.

Besides being cost effective, baobab ingredient market has attracted the attention of industry participants for its sustainability, both from environmental and socioeconomic aspects. Some baobab ingredient producers such as Baobab Foods, have helped rural families of South Africa to earn a sizeable income and gain access to medical and educational facilities by working with them to hand-harvest the fruit.

Given that there is rising population of health-conscious consumers who are demanding more nutrient-dense foods and are able to spend the extra cash required to afford exotic fruits and vegetables for not only their nutritional goodness but also for their exotic taste, it is predictable that opportunities for baobab ingredient industry players will continue to grow. Baobab is already being utilized by not only brand leaders in the food and beverage industry but also by big box retailers and private label brands, accounting for mainstream demand and acceptance. According to data provided by African Baobab Alliance, baobab exports rose from 50 tons in 2013 to 450 tons in 2017. With estimates showing that consumption of baobab ingredient to surpass 180 kilo tons by 2024, it is anticipated that baobab ingredient market would be one of the profitable investment avenues between 2018-2024.