North America automotive NFC market to procure substantial proceeds by 2025, rise in mid-range electric vehicle sales to augment industry growth

Publisher : Fractovia | Published Date : May 2019Request Sample

Driven by the growing sale of smart connected vehicles, the automotive NFC market is anticipated to register substantial revenues over 2019-2025. This demand is mainly attributed to the product features like mobile connectivity, wireless charging, voice control, smart infotainment system and more, technologies that have advanced significantly owing to the integration of Near-field Communication (NFC) system. In relation to standard Bluetooth technology, NFC consumes less amount of energy. Its low range connectivity feature allows pairing close proximity devices with greater ease. This feature is becoming increasingly important across crowded areas where there is a high possibility of interference caused by other connected devices.

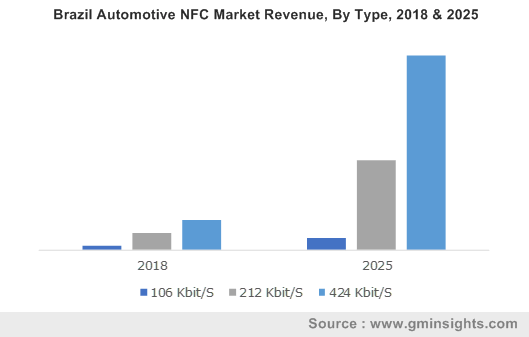

Brazil Automotive NFC Market Revenue, By Type, 2018 & 2025

With advanced features like wireless locking/unlocking of doors, easily pairing with infotainment system and mobile engine starting, NFC based solutions have offered enhanced flexibility and access to drivers. It has also opened new possibilities in the car sharing market, allowing companies to enable boarders’ smartphone to unlock and start their rental car using NFC. Additionally, the rising sales of high-end luxury vehicles have proved to be specifically beneficial for the automotive NFC industry, over the past couple of years. For instance, in 2018, German auto giant BMW launched its new 4th generation BMW X5 SUV and 8 Series Coupe which was the first to be equipped with BMW Digital Key option that allows locking/unlocking of vehicle as well as enables keyless engine start using NFC enabled smartphone.

Interior application of NFC contributed to 71% revenue share of automotive NFC market in 2018. The interior segment includes features like vehicle engine access, infotainment system, air-conditioning, and ADAS (Advanced driver-assistance systems) communication which primarily use NFC technology and are increasingly found in today’s low to high-end vehicles. The ability to simplify the pairing process is the primary factor driving NFC usage in the automotive sector.

For instance, consumers using NFC can unlock their vehicles and configure it according to their preferences using their smartphone while in close proximity to the vehicle. Additionally, an NFC enabled smartphone can receive diagnostic data such as vehicle service record, fuel consumption and mileage which can be viewed by the users. Moreover, using GPS, a vehicle’s location coordinates can be displayed on user’s phone via NFC, enabling easy vehicle access particularly in crowded areas or large parking lots.

With renowned automakers offering advanced features in their mid-range vehicles, the automotive NFC industry is anticipated to depict considerable momentum in a couple of years. Citing recent advancements, in 2019, Hyundai Motor Group announced the development of a ‘Digital Key’ which could be downloaded on the user’s smartphone and, using NFC technology, could be used to control selected vehicle systems such as mirror and seat adjustments, infotainment pre-sets, and navigation destination pre-sets.

The mid-range vehicle segment is anticipated grow significantly over the forecast timeline. Automakers are currently offering in-built vehicle features such as advanced infotainment system that controls audio and video configuration, aircon setting, lights setting and more. The lower power consumption feature of NFC has certainly helped enhanced such features, promoting its incorporation in mid-range vehicles.

The automotive NFC industry growth is also attributed to the rising number of electric vehicle (EV) sales across emerging economies. Reportedly, federal policies and regulations aiming towards curbing global carbon footprint have led automakers to develop electric vehicles which seemingly offer more enhanced vehicular features compared to traditional petrol and diesel vehicles. The trend is mainly registered across countries of North America and Europe where EV sales have skyrocketed in the past couple of years.

Impact of North America electric vehicle sector on the automotive NFC market

Reports cite that the North America automotive NFC industry will record a CAGR of over 32% over 2019-2025. With the presence of EV maker like Tesla, the region’s electric vehicle market has been incorporating advanced smart driving features into automobiles, which has generated a wave of opportunities in the integration of NFC solutions. In the U.S., fully electric car sales are reportedly increased by around 47% in 2017, with Tesla’s Model 3 Sedan leading the sales.

Moreover, deployment of supercharging networks across city centers has opened new opportunities for integration of NFC technology lately. For instance, U.S. EV infrastructure firm ChargePoint has recently announced a new feature that allows EV owners to initiate charging using their NFC enabled smartphone. The feature, to be made available across 40,000 charging spots across North America, will be compatible with Android, iPhone, or Apple watch devices and is anticipated to reduce charging duration, advancements that will augment automotive NFC market reach across the region.

NFC technology has enabled a multitude of advanced in-vehicle functions in today’s automotive industry. It has been commonly used for pairing user devices for enabling communication between the users and their vehicles for information retrieval and car key access based on NFC interface. With growing product adoption, the global automotive NFC market is likely to exceed USD 6 billion by 2025.