Aftermarket-based automotive logistics market to gain massive proceeds by 2025

Publisher : Fractovia | Published Date : 2019-07-02Request Sample

The expanding growth pace of the aftermarket worldwide in the countries has remarkably driven automotive logistics market growth in the last half a decade. The consistent practice of companies exporting parts to other countries for assembling will help impel the industry as well. Say for example, import of auto parts in the U.S. to assemble automobiles there and export of passenger cars from Europe to China has considerably propelled automotive logistics industry size. The increase in the production of light commercial vehicles worldwide will also propel the business growth.

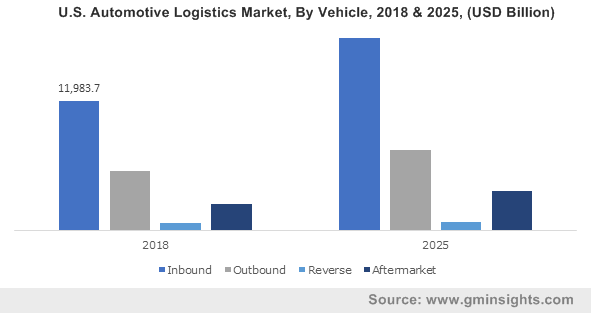

U.S. Automotive Logistics Market, By Vehicle, 2018 & 2025, (USD Billion)

Surging demand for commercial vehicles has lent considerable traction to automotive logistics market. There has been a significant growth in LCV manufacturing in the recent years. In the year 2017, total number of LCVs produced worldwide was 19,481,394 units which increased by 5.9 percent to 20,635,799 units in the year 2018. The rise in LCV production and universal auto trade will thus impact automotive logistics industry landscape.

In 2018, around 19% of all commercial vehicles made worldwide were manufactured in Europe. Nearly 3,451,485 units of commercial vehicles were manufactured in Europe and the number is anticipated to rise in the forthcoming years. Europe is a key regional ground for the auto industry worldwide, delivering high quality 'Made in Europe' products around the world. The escalating commercial vehicle production in the region is likely to majorly impel Europe automotive logistics industry size.

Currently, the largest passenger cars exporter to China is the European Union which accounts for 53.3% of total Chinese car imports by value. Growing number of commercial vehicles being manufactured in the Europe and rising export will support automotive logistics market size over the coming years.

Greater China is one of the major regions contributing to the growth of automotive logistics industry owing to the presence of large number of manufacturers and production facilities in the country. For instance, in 2018, Greater China region manufactured the largest number of commercial vehicles estimated at 5,126,854 units, contributing a share of 27 percent to the worldwide production.

China has been reported to top the list as far as manufacturing operations are concerned. In 2016 alone, the automobile production and sales of China exceeded 28 million units, ranking first in the world for the past eight years. As per the China Automobile Dealers Association (CADA), in 2018, nearly 13.82 million used cars were traded in China. The extensive growth pace of auto manufacturing in the region is likely to catapult China automotive aftermarket, further propelling the regional automotive logistics industry share.

It has been estimated that over 2020-2025, aftermarket service will account for 45 to 55 percent of the total auto industry value chain revenue owing to the demand for used cars. The rising requirement of a well-organized supply of raw materials and finished components by OEMs is supplementing manufacturing sector and significantly accelerating automotive logistics market share.

In order to gain tariff benefits provided by the regional governments to foreign investors, most of the automakers have been establishing their production plants at high revenue generating locations and importing their vehicles to other countries. For instance, as per German Association of the Automotive Industry, German automobile manufacturers produced 750,000 vehicles at their U.S. based plants in 2018, out of which 56 percent were exported to China and Europe. In addition, German carmakers had imported 470,000 vehicles from Europe to U.S. in the same year. This trend is expected to majorly drive the overall automotive logistics market share.

The U.S. dependency on imported light vehicles and automotive parts to meet consumer demand will enhance the revenue portfolio of automotive logistics industry. While the United States produced over 11 million light vehicles in 2018, light vehicle sales were recorded at 17.3 million. In 2017, the value of imported parts and light vehicles totaled to exceed $340 billion. In the same year, 48 percent of all vehicles sold in the United States were imported. The changing dynamics of the regional automotive industry as far as vehicle part imports are considered will augment U.S. automotive logistics market trends.

According to National Highway Traffic Safety Administration, the average vehicle manufactured in the United States depends on 40% to 50% imported components and parts. The auto trade of the country has significantly accelerated automobile logistics market and is expected to continue doing so in the forthcoming years. The automotive trade market of the U.S. has also been backed by the emerging automotive aftermarket industry owing to the strong economic growth.

Increasing production and universal trade of vehicles in the countries like the USA and China have influenced automotive logistics market positively. The emergence of aftermarket has proved to play a significant role to stimulate automotive logistics industry. According to a new research report by Global Market Insights, Inc., automotive logistics market size is estimated to surpass $170 billion by 2025.