Automotive composites market to gain remarkable proceeds via heavy demand for glass and carbon fibers over 2017-2024

Publisher : Fractovia | Published Date : 2018-02-01Request Sample

In the last few decades, automotive composites market size has indeed depicted a major rise, subject to the demand for making automobiles weigh lesser, more fuel-efficient and more effective in controlling carbon emission. Alternative materials other than steel that are lighter such as aluminum and magnesium had long been used for manufacturing structural and semi structural parts of automobiles, but composite components are slowly and steadily taking over the automotive industry, as they are increasingly being used in all types of vehicles - sports, luxury, multi-utility, light and medium duty as well as sports utility vehicles and mini vans. The exponential growth graph of automotive composites industry has proved that the deployment of composites helps increase cost savings in the automotive sector. In the ensuing years, automakers are likely to strive even further to abide by governmental restrictions on emission and consumer demand for decreased fuel consumption, on the grounds of which the automotive composites market will witness improved growth prospects over 2017-2024.

U.S. Automotive Composites Market, By Fiber, 2016 & 2024, (Kilo Tons)

The emphasis on making automobiles more light weight and fuel efficient had emerged from the alarming climate change, mainly brought about by greenhouse gas emissions. In fact, excessive transportation is principally being held responsible for contributing to more than a quarter of the total greenhouse gases present in the environment. As a substantially higher percentage of fuel burns in running a heavy vehicle than a lighter one, the concern for global environmental preservation has played a pivotal part in the growth of the automotive composites market. In consequence, light composite materials such as glass fiber, carbon fiber, hybrid glass-carbon fiber and natural fibers have been increasingly preferred over traditional and heavy, riving automotive composites industry share.

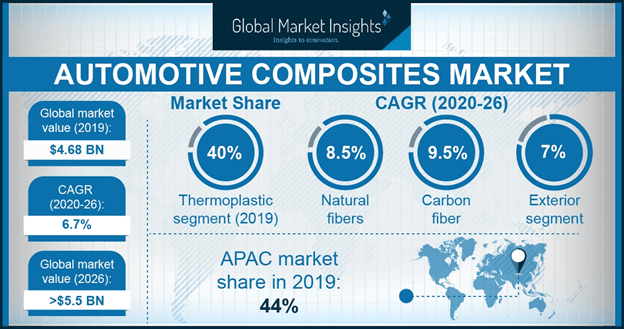

In 2016, glass fiber held 70% of the automotive composites market share, pertaining to the product’s cost effectiveness when compared to carbon fiber composites. It is estimated that glass fiber composites can in fact, make a vehicle 15% to 30% lighter when compared to a vehicle with steel parts. Carbon fiber composites, that are even lighter than glass fiber composites will witness a growth rate of more than 10% in the automotive composites market over 2017-2024. Though carbon fiber composites are superior when it comes to decreasing carbon footprints and making vehicles more fuel efficient, the automotive industry has been slow on the uptake to adopt them due to high cost of manufacturing. However, research and development programs are being conducted extensively to bring down the cost of carbon fiber as well as to develop less expensive precursors of carbon fiber, that would certainly boost automotive composites industry.

It is also imperative to state that carbon fiber composites have proved to be 30% lighter than glass fiber composites, though, subject to their high costs, they are being used only in luxury cars and high-end sports cars, contributing to a very niche sector in the automotive composites market. However, hybrid composites manufactured using varying ratio of glass and carbon woven fabric have opened up a lucrative growth avenue in automotive composites industry. When used in vehicle exteriors, it has become evident that using composites laminated with 50% ratio of carbon fiber reinforcement leads to components exhibiting maximum flexural properties, while the highest compressive strength is achieved when carbon and glass fibers are used in alternating arrangement.

The manufacturing procedure adopted for the production of composite fibers is also a determining force behind the growth of the automotive composites market. Compression molding has been one of the most prevalent manufacturing procedures in the automotive composites industry and was valued at over 6 billion in 2016. Ease of manufacturing along with growing investment in reducing the cycle time for production have indeed contributed to the popularity of compression molding in the automotive composites industry. Injection molding will also hold a prominent place in automotive composites market due to the ease of mass production and better finish of products obtained through this process.

With composites having found extensive usage in both interior and exterior as well as structural parts of automobiles, automotive composites market size has indeed been growing exponentially. Exterior application of composites, as per reports, led automotive composites market by contributing over 35% to the overall share in 2016. However, due to the increasing adoption of natural and glass fiber, automotive composites market size from interior applications will also witness a heavy ascent over 2017-2024.

Original equipment manufacturers (OEMs) especially in North America and Europe have been aiming to decrease automobile weight, keeping in line with the strict environmental regulations that have been put in place by most governments across the globe. Drastic measures employed by OEMs have promoted the growth of automotive composites market, leading to innovations and research programs targeted at bringing down carbon levels in the air. The introduction of new materials and hybrids that will potentially change automotive design to become sleeker and more energy efficient, is thus, slated to heavily influence automotive composites industry outlook.