Unveiling automotive electronics control unit (ECU) market trends with respect to the product development strategies undertaken by prominent industry contenders

Publisher : Fractovia | Published Date : 2018-10-04Request Sample

Having experienced a paradigm shift from mechanical to electronic systems to modernize conventional engines, automotive ECU market has now come into the mainstream. With the evolution of automobiles, most of the vehicular systems have been integrated with electronic components. In line with the ongoing transformation in the automotive sector, the shifting focus of automakers to improve infotainment systems will also have a considerable impact on the automotive electronics control unit (ECU) industry share. In addition, the increasing importance of EVs for curbing carbon footprints will also majorly impact the industry expansion.

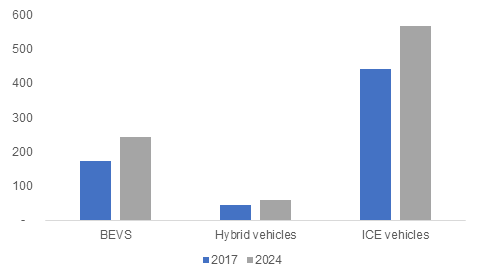

U.S. Automotive Electronics Control Unit (ECU) Market, By Propulsion Type, 2017 & 2024 (Million Units)

As of now, most of the vehicles have been incorporated with different modules of ECUs which have been mainly deployed to improve the performance, safety, efficiency, and comfort. Considering the benefits that ECUs render in vehicles, several OEMs have been changing their focus regarding the advancement of vehicles in terms of cruise control, power steering, infotainment, connected cars, and autonomous driving assistance. The on-going innovations related to the aforementioned pointers will have a significant influence on the product demand over the years ahead. The succeeding paragraphs provide details about novel product development tactics adopted by various OEMs in order to consolidate their stance in the industry.

Over the last few years, regulatory bodies and regional governments have become more aware of the increasing number of road accidents, on the grounds of which they have been encouraging OEMs to bring forth next-generation vehicles. In fact, the shifting focus of automakers toward the development of connected cars and autonomous vehicles for maintaining the safety of vehicle occupants as well as pedestrians is poised to impel the automotive electronics control unit (ECU) market outlook. Recently, in order to ensure the optimum usage of data analytics and AI in the automotive industry, a technology leader, Teraki has raised USD 3 million for supporting its automotive customers. As of now, the automotive industry is extensively using AI for fulfilling its growing need of data analytics in self-driving and connected cars which are facing issues related to data processing. There will thus be lucrative opportunities for the OEMs and technology providers in automotive ECU market in the future owing to the significant use of software systems to analyze the data collected from ECUs, vehicle sensors, and AI to enhance the vehicle safety.

It is noteworthy to mention that the numerous technology companies have been collaborating with leading automakers to incorporate new technology trends in the vehicles. For instance, the Internet giant, Google has signed a deal with Renault-Nissan-Mitsubishi Alliance to develop a most pleasant car-infotainment system in 2018. Through this multi-year agreement with Google, the automotive alliance will integrate Android services in its infotainment systems. The future plan of this consortium to equip vehicles with next-generation technology is slated to stimulate the automotive electronics control unit (ECU) market size.

In addition to the advanced technology integration in the vehicles, most of the geographies have been deploying electric vehicles (EVs) on a large scale for improving energy efficiency and reducing carbon footprints. It is to be remembered that policymakers have raised concerns related to the rise in carbon dioxide levels that have been having a hazardous impact on the biodiversity. In addition, most of the countries are looking forward to reducing the dependency on the fossil fuels for energy need. Equipped with a motive to be a part of the green energy revolution, several regional governments have been investing in the development of EVs infrastructure, the rising prominence of which will fuel automotive ECU market size in the ensuing years.

The surging use of various embedded and software system in vehicles for maintaining precise functionality is slated to enhance the future product demand. Moreover, in the years to come, the electric vehicle mania will generate lucrative opportunities for the industry players pertaining to their increasing popularity over conventional vehicles. Driven by the widespread scaling of electronic systems in several automotive applications, automotive electronics control unit (ECU) market will surpass a revenue collection of USD 95 billion by the end of 2024.