Aseptic Packaging Market to register appreciable gains from the packaged food & beverage sector over 2017-2024

Publisher : Fractovia | Published Date : 2017-12-12Request Sample

Aseptic packaging market, in recent years, has come to thrive as a rather profitable business space, owing to the increasing demands for processed and packaged food and disposable healthcare instruments like vials and prefilled syringes. With hectic work schedules and changing lifestyles around the globe, packaged food is steadily replacing home-cooked meals, a trend that has given a boost to the packaged food and beverages industry, indirectly propelling aseptic packaging market share. It is also prudent to mention that dual income households have led to consumers willing to pay more for healthier food packages, which would indeed provide a positive impetus to aseptic packaging industry size, estimated to register a 9.9% CAGR up to 2024.

Europe Aseptic Packaging Market Size, by Product, 2013 – 2024 (USD Million)

The term ‘aseptic’ can be translated to mean the exclusion of any unwanted organisms from a typical food or pharmaceutical product. The aseptic process of packaging uses flash pasteurization and sterile packing of the product ensuring its lasting freshness and shelf stability. Aseptic packages are treated to withstand 127°C and 100°C for high and low acid products respectively, making them perfect containers for dairy and pharmaceutical products, inherently impelling aseptic packaging market.

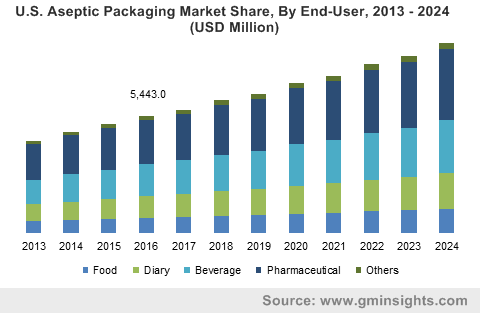

The product landscape of aseptic packaging market comprises cartons, bottles, vials, ampoules and pre-filled syringes. Bottles and cartons among these, are particularly deployed in the packaged food industry, the biggest end-user of the aseptic packaging market, which is appraised to witness 8% CAGR over 2017-2024. Emerging economies as well as developed nations are likely to contribute toward the growth of the packaged food domain, given the soaring demand for pre-packaged and ready-to-eat food worldwide. In consequence, aseptic packaging industry share from cartons has been forecast to attain the biggest share by 2024, with a CAGR anticipation of 9% over the forthcoming seven years. This growth projection can primarily be attributed to increasingly widespread use of aseptic cartons for packing dairy products as well as high acid content beverages. It is prudent to mention that aseptic packaging keeps these products fresher and preserves their original taste without the requirement of added preservatives. The desirability of consuming something that is unadulterated by preservatives has a greater appeal and benefit for the consumers. Thus, aseptic packaging industry has been gaining prominence due to increasing public awareness regarding the consumption of aseptic packaged food as opposed to food packed in cheap plastic containers. Given that governments around the globe are also in favor of aseptic carton packs owing to their recyclable and eco-friendly nature, aseptic packaging market share has been gaining mass appeal lately.

Consumers have always depicted greater preference for novel and practical packaging designs as far as food & beverage products are concerned. Recently Tetra Pak, the aseptic packaging industry giant, launched the aseptic bottle called Tetra Evero. The biodegradable nature of this bottle combined with the aspects of new design, enhanced hygiene and food safety and increased longevity of food is likely to greatly attract customers to try out the product. The longer shelf life of the packaging is one of the key reasons why Tetra’s products fare better in Europe, since European homes and supermarkets have smaller refrigeration areas than their North American counterparts. The aforementioned pointer may also be indicative of why aseptic packaging industry has greater prominence in Europe than in North America. Nonetheless, the notion of pre-packaged food is commonplace in North American and Europe since a while now. The advent of aseptic packaging, ensuring the longevity and shelf stability of the packaged food without the addition of preservatives, has made consumers incline further toward aseptic packaging in these continents.

In fact, it has been estimated that the Tetra Evero will interest a large section of consumers in the hurricane prone areas of south east America, as hurricanes limit consumer access to refrigeration. In this regard, analysts claim that aseptic packaging market will continue to thrive in places that have limited access to refrigeration but high demand for packaged food.

Asia Pacific had been leading the aseptic packaging market in 2016, while its shares are expected to surpass USD 25 billion by 2024. Owing to rapid urbanization, advent of supermarkets and increasing proportion of the female workforce in countries like India and China, pre-packaged and ready-to-cook foods have gained mass popularity in APAC. The demand for foreign foods in local markets is also contributing to the growth of the aseptic packaging market in the region, state experts. Furthermore, the changing consumer preferences in countries like Indonesia and Australia will also help augment this business space across APAC.

Aseptic packaging market worth is estimated to be over USD 70 billion by 2024, driven by the huge demand from the food processing and packaging sectors. The demand for nutrient value retention, less per unit product cost, and uniform product quality have emerged as driving forces for aseptic packaging industry. Furthermore, these products facilitate easy dispensing and disposal and help combat the BPA (bisphenol A) controversy, which would substantially drive aseptic packaging market share over 2017-2024.