Saudi Arabia artificial lift systems market to witness notable growth prospects over 2018-2024, technological innovations to leave a marked impact on the industry landscape

Publisher : Fractovia | Latest Update: 2018-11-22 | Published Date : 2016-06-19Request Sample

The global artificial lift systems market has been experiencing a transformational shift in dynamic since the last decade or so. The perception of change can be aptly attributed to the growing number of stripper and marginal wells along with the increasing demand for crude oil. As the impact of technological advancements is felt across the oil industry, in tandem with the rising demand for operational efficiency, artificial lift systems market is expected to traverse alongside a profitable growth path in the years to come.

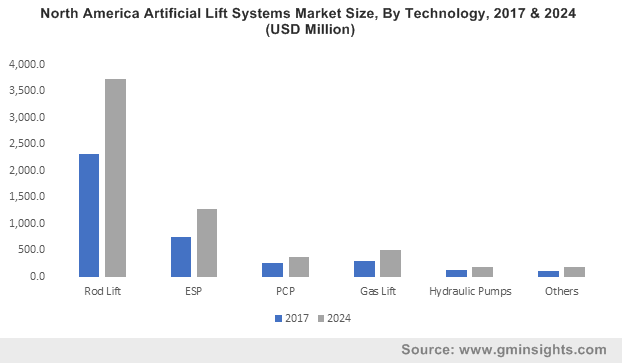

North America Artificial Lift Systems Market Size, By Technology, 2017 & 2024 (USD Million)

The positive outlook toward bringing down the cost of oil production along with the escalating demand for petroleum products have a major role to play in the expansion of artificial lift systems industry. Of late, the production and consumption of oil and gas has been on a continuous rise – a factor that would also serve to impel this vertical, especially across Middle Eastern provinces such as Saudi Arabia. Saudi Aramco, the renowned Saudi Arabian Oil Company, for example, has recently suggested plans to assist in compensating for the natural reduction from mature fields by conducting additional drilling at existing fields. The ongoing plans and strategies from the government to raise the production of crude oil will thus augment the regional market share.

Speaking of Saudi Arabia, it is prudent to mention that the region is bound to emerge as one of the most remunerative revenue pockets for artificial lift systems market. The extensive availability of proven oil reservoirs in the region is likely to be a major driving factor for the regional growth. That said, the surging focus in the province toward mature oil fields in tandem with the humongous investments across the upstream sector will also help propel Saudi Arabia artificial lift systems market.

The global artificial lift systems industry is also remnant of incredible innovations – indeed some of the most recent technological developments in this business vertical border along retrofit capability, smart alarms and real time monitoring. The evolution of multiphase gas handling pump to operate the artificial lift systems continuously has also escalated the popularity of these products, further augmenting the growth of artificial lift systems market.

Elaborating further on the prominence of technology in this vertical, it is prudent to mention the incidence of General Electric Oil & Gas, which in October 2014, launched its next-generation surface control system known as Vector Plus variable speed drive (VSD) for electric submersible pumps (ESPs). Operators using Vector Plus VSD could increase ESP motor speed gradually and adjust ESP speed remotely from the surface with improvised intelligent control capabilities and greater ease of use. General Electric’s Vector Plus vividly signifies the commitment of the company towards artificial lift innovations in the expanding unconventional space.

Citing yet another incidence of the innovations in artificial lift systems market, in 2016, Tenaris showcased its BlueRod and HolloRod-series in the SPE Artificial Lift Conference and Exhibition. The premium sucker rod, BlueRod, designed for high loads, was touted to ensure excellent field performance and improve the life of rod. The company also discussed the hollow sucker rod from the HolloRod-series which reduced the operations costs, as well as escalated the dependency of progressive cavity pumping (PCP) operations. Advancements such as the aforementioned in equipment will further drive the artificial lift systems market trends.

Recently, Schlumberger introduced the GyroSphere MEMS which was aimed at reducing drilling risks for E&P operators and increasing drilling efficiency and reliability. The GyroSphere sensor conducts gyro surveys more quickly compared to the conventional systems and reduces the requirement for recalibration between runs. The GyroSphere service is focused in lowering uncertainties in gyro survey by up to 45 percent.

Halliburton had also introduced a drilling engineering solution (DES) service in 2014, to deliver custom engineered, fully integrated solutions in order to make the best use of well design and placement, from complex environments to high volume wells. DES combined the experience and expertise across various product service of Halliburton like Baroid, Halliburton Drill Bits and Services and Sperry Drilling, and is powered by Landmark Software.

The aforesaid instances rather coherently testify the impact of technological innovations on artificial lift systems market. This has led to several vendors striving to tap technology and bring to the forefront, a spate of advanced lift systems that would resolve major obstacles across drilling and exploration activities. Driven by a highly fierce competitive landscape, in tandem with the rising number of onshore and offshore drilling activities, artificial lift systems market size is expected to be pegged at USD 14 billion by 2024.