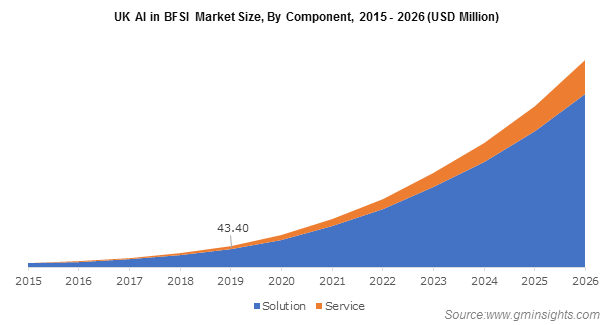

Artificial Intelligence in BFSI market to record a staggering CAGR of 30% over 2018-2024, commendable contributions by financial giants to characterize the industry landscape

Publisher : Fractovia | Published Date : 2018-06-04Request Sample

Persistently being channelized by cutting edge technologies, the deployment of artificial intelligence in BFSI market is aptly bringing a revolution in the operation model with regards to hassle-free efficient transaction. In an era of digitization, where consumers have been increasingly expecting more individualized and compelling services from banks, adoption of AI in BFSI industry is showing great level of interest. Artificial Intelligence has already made its presence felt in the banking infrastructure, providing smooth differential customer experience and security assurance on digital channels.

Armed with an intent to unabashedly harness the maximum of its power, potential contenders in the financial realm have been trying their hands out on these advanced analytics solutions to gain consumer loyalty. Say for instance, renowned British investment bank, Barclays is apparently planning to develop an AI system that would allow their customer to communicate with a device directly and get all the information that they would require for vital transaction. Swiss Bank UBS has also made to the headlines recently with the announcement of its deployment of robots on trading floor to enhance traders’ performance.

U.S. Artificial Intelligence in BFSI Market Share, By Solution, 2017 (USD Million)

Automation is certainly the focus of interest which has triggered penetration of artificial intelligence in BFSI market. Most of the banks are making agonizing attempts to deploy automation technologies with an anticipation to deliver new wave of productivity, in tandem with improvement in cost savings and customer experience. Despite some of the early setbacks in application of robotics and AI in banking processes, the growth prospect of AI in BFSI industry is claimed to be humongous. The technology is rapidly maturing with domain expertise getting developed among both vendors and banks.

A succinct outline of the corporate landscape of AI in BFSI market:

Financial industry giant JPMorgan Chase, has recently introduced COiN platform (Contract Intelligence) particularly designed to access legal documents and fetch valuable data and clauses via advanced analytics. This groundbreaking technology is reportedly based on advanced machine learning algorithm that claims to make operation superfast. Manual review of twelve thousand annual commercial credit agreements that normally requires nearly 173 years, initial implementation of this proposed ML based technology allegedly cold review it in just few seconds. Judging its immense potential, experts believe it to be one of biggest innovations that AI in BFSI market has lately witnessed. The initiative also reflects on the fact that ML based artificial intelligence in BFSI industry is driving the technology landscape. In fact, this particular business vertical procured almost 38% of the overall industry share in 2017.

According to experts, utilization of AI in BFSI industry that has brought a renewed realm of connectivity, ultimately led to an enhancement in the organizational structure. Probably having recognized this immense potential, Wells Fargo, another leading name in the business has recently set up its new AI Enterprise Solutions team, this February. Sources claim, the proposed AI group working under the umbrella of Virtual Solutions, Innovation Group, and Payments, would be mainly targeting three goals- increasing payment connectivity and bring forth new opportunities via AI utilization. Last month, the organization began piloting an artificial intelligence-driven chatbot via Facebook messenger platform. If reports are to be relied, this virtual assistant device communicates with users to offer them account information. Considering its progressive initiations toward driving FinTech, it wouldn’t be incorrect to state that Well Fargo’s contribution will prove to be influential in proliferating AI in BFSI market trends.

With an eye to gain a competitive advantage in the strategic landscape, Citibank has made its way to the front page with its recent succession of partnerships with tech giants to improve the services. In its lucrative portfolio of recent investment via its investment and acquisition wing Citi Ventures, most of the attention has been gained by its hefty investment in Feedzai. The latter is a leading data science enterprise that claims to identify and eradicate fraud among all avenues of commerce as it works in real time analysis. Citi Group’s investment in this startup aptly depicts the transformative trend in the banking sector where companies have been increasingly joining forces with connecting technology giants to ensure maximum utilization of AI in BFSI market.

While a plethora of sectors have borne the impact of artificial intelligence, AI in BFSI industry seems to be next in the revolution queue. Of course, the aforementioned instances quite vividly reflect that banking sectors are at the vanguard of the industry, having procured more than 50% of the global share in 2017. Leading commercial as well as investment banks have been proactively implementing strategic technological advancements, with huge investment in AI application, in a bid to ensure better consumer experience. The future of finance would be extensively influenced by fintech, which would set the stage for AI in BFSI industry to hit a revenue of USD 25 billion by 2024.