APAC aquafeed market to derive remarkable gains over 2017-2024, increased R&D activities and innovative product launches to characterize industry growth

Publisher : Fractovia | Published Date : 2017-06-23Request Sample

Over the recent years, the aquafeed market has been vigorously strengthening its stance in the overall food, nutrition, and animal feed industry owing to the rising level of awareness among the global population regarding the health benefits of consuming seafood. According to medical experts, the occurrence of cardiovascular diseases lowers significantly due to regular consumption of seafood, especially fish. In consequence, a diverse set of populaces residing in different geographical regions across the globe have apparently been including seafood in their dietary habits, given that there has been an overwhelming upsurge in the incidences of lifestyle diseases such as obesity, diabetes, and other heart-associated ailments. Moreover, it would be prudent to mention that fish oil is extensively utilized in manufacturing numerous medicines – a factor that would further contribute toward augmenting the aquafeed market share over the forthcoming years. Bearing testimony to the aforementioned assertions is the recently compiled research report by Global Market Insights, Inc., which states that the global aquafeed industry size would surpass a total consumption volume of around 115 million tons by 2024.

Europe Aquafeed Market Size, By End-Use, 2016 & 2024, (USD Million)

Elaborating further on the probable alterations in this business space, it has been observed that numerous aquafeed market participants have been concentrating on producing environmentally responsible fish feed substitutes in the recent times. A marked uptick in fish consumption invariably calls for their healthiness as well - a factor that has further contributed toward the global aquafeed market share expansion. For instance, the US based biotechnology firm KnipBio has recently unveiled a line of aquafeed ingredients which consists of a natural carotenoid, named as bio-astaxanthin, that offers significant health advantages to various fishes such as shrimp, salmon, and rainbow trout. The latest breakthrough is reportedly being described as a new source of biologically produced feed alternative, an anti-oxidant to be precise, which is said to enhance disease resistance ability, improve feed conversion rates, lower embryonic mortality, and fasten the pace of growth in fishes. It goes without saying that the launch of such powerful immune-boosting prebiotic feed alternatives would subsequently encourage the aquafeed industry stakeholders and provide a renewed vigor to the fish harvesting community across the globe.

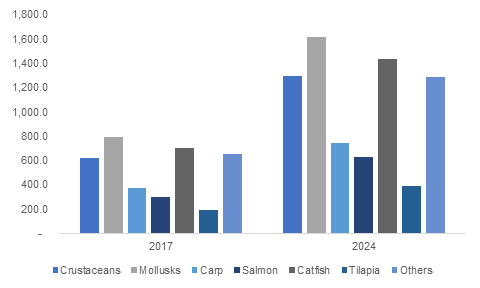

Speaking in terms of geographical growth vistas, the Asia Pacific aquafeed market dominated the overall business space with the region apportioning over 65 percent of the total global fish production in the year 2016. Owing to freshwater availability and ease of farming technology Asia Pacific region is anticipated to make strong headways in the global aquafeed market over the next seven years of timespan. Amongst the prominent economies of the region, India has steadily emerged as the principal growth avenue of the overall Asia Pacific aquafeed industry in the recent times. The country has an astounding coastline of approximately 7,517 km and boasts of 14 prominent and 44 other small streams and rivers – facts that explain the foremost standing of India in the global aquafeed industry. Citing a recent development to demonstrate the centrality of India’s position in this business space, Cargill Inc. has operationalized its first aquafeed production facility in the state of Andhra Pradesh in India. The American conglomerate would reportedly accentuate its aquafeed manufacturing capacity in the country by threefold, which is said to reach 90,000 tons per annum in the foreseeable future. Needless to mention, various aquafeed market players have been making extensive efforts to fortify their presence in India. Apart from India, expansion strategies being undertaken by industry giants in China has impelled the product penetration in the nation’s aquafeed market. Furthermore, ease of farming technology along with increasing salmon fishing owing to land based farm systems would spur the China aquafeed market growth. Driven by India and China, the Asia Pacific aquafeed industry is estimated to exceed USD 125 billion over 2017-2024, as per authentic estimates.

In addition to this, inexpensive labor, bountiful resource availability, ambient environmental conditions coupled with increasing disposable incomes would propel the overall APAC aquafeed industry amplification in the next seven years. Apparently, the aforementioned declarations go on to demonstrate the endless growth opportunities awaiting the leading market participants in India’s resurgent aquafeed industry. In terms of global commercialization scope, aquafeed market share is anticipated to exceed a valuation of USD 200 billion by 2024.