U.S. animal diagnostics market to hold major revenue over 2017-2024, Increasing investments in veterinary diagnostics to drive the regional landscape

Publisher : Fractovia | Published Date : 2018-06-14Request Sample

Zoetis, acclaimed as one of the foremost firms operating in the global animal diagnostics market, in its recent announcement has unveiled that it will be purchasing Abaxis for USD 1.9 billion, as it looks to account for a major chunk of the fast-growing business of veterinary diagnostics services. The acquisition, according to reports is expected to help Zoetis lower its reliance on its vast animal dermatology business that is facing looming competition from emerging startups and other smaller firms.

India Animal Diagnostics Market, By Technology, 2013 – 2024 (USD Million)

As a matter of fact, the New Jersey-based Zoetis said that it believes the veterinary diagnostics equipment category to be advancing faster than the overall animal health industry, given the robust market demand outside of U.S. Quite overtly, the purchase deal will expand Zoetis’s presence in the global animal diagnostics market, which according to experts would bolster its expansion efforts.

Elaborating along similar lines, the competitive landscape of animal diagnostics market seems to be quite consolidated in nature with prominent players opting for M&As and partnerships for strengthening their respective positions. Rising disposable incomes coupled with significant advancements in veterinary diagnostics has undeniably propelled the industry fellows to upscale their manufacturing capabilities and product portfolios. An instance providing testament to the aforesaid statement is that of Zoetis, that has recently launched Carysta HVC (High Volume Chemistry), a diagnostic instrument designed to advance productivity as well as to reduce the cost of the process.

Yet another prominent animal diagnostics industry player in line is Heska, that has inked a licensing agreement and product development partnership with a renowned clinical diagnostics and life sciences technology company MBio Diagnostics. According to an official statement, the duo will jointly bring forth new point-of-care multiplex testing technologies to the animal health & wellness sector.

The aforementioned instances vividly illustrate that animal diagnostics market is lately witnessing a plethora of technological advancements, given the sincere efforts undertaken by prominent industry players to develop faster, precise, and cost-effective diagnostics techniques. While the competitive landscape by itself has been striving to expedite the revenue of this vertical, the regional spectrum of animal diagnostics industry is also likely to witness significant investment trends with growing fad of pet adoption.

As per the statistics revealed by the American Society for Prevention of Cruelty to Animals (ASPCA) in 2018, around 3.2 million shelter animals are adopted annually in the U.S. This estimate certainly stands as a validation to the fact that the United States in the recent years has become a potential investment hub for animal diagnostics market. The extensive investment trends in the U.S. can be majorly attributable to the robust growth in pet adoption for companionship along with rising disposable incomes leading to a substantial increase in pet care expenditure.

Reliable reports affirm that U.S. animal diagnostics market accounted for the largest regional share in 2016 and is further anticipated to witness significant growth in the ensuing years. Along with the U.S., France, UK, and Brazil are other prominent regions were the animal diagnostics industry is likely to witness lucrative growth prospects in the years ahead. France in fact, has been replete with a wide number of research programs lately with regards to the production of veterinary diagnostics and reagents. That said, even the presence of strong companies such as Virbac in the country and their persistent efforts to introduce advanced technologies will propel France animal diagnostics industry size.

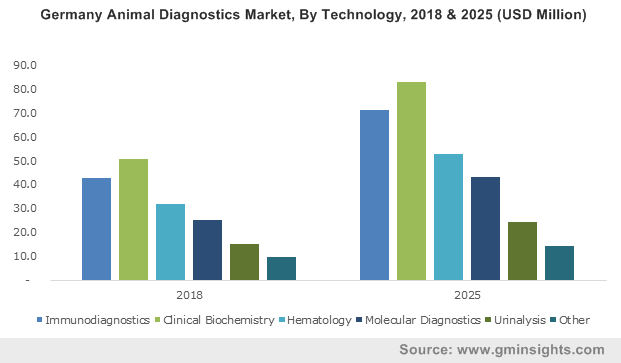

Quite overtly, animal diagnostics as well as nutrition have assumed a role far bigger than anticipated in the past few years. In the current industry scenario, molecular diagnostics has been gaining significant momentum as the popular technology allowing easy detection, genotyping, and identification of pathogens that has led to further advancement in animal diagnostics market trends. It can be concluded that ongoing R&D activities for studying host-pathogen interactions, vaccine development, resistome analyses, development of diagnostic assays and genome analysis in the animal diagnostics industry have opened new growth avenues through which manufactures can garner hefty proceeds. Powered by rapid technological advancement and product innovation trends, the global animal diagnostics market, has been projected to surpass USD 5.4 billion by 2024 at an annual growth of 8% over 2017-2024.