Transportation sector to majorly drive aluminum alloys market growth, APAC to account for over two-third of global industry share by 2024

Publisher : Fractovia | Published Date : 2017-05-11Request Sample

The global demand for aluminum alloys market is slated to soar over the years ahead, thanks to the growth of transportation industry. Accounting for more than 45% share of the global aluminum alloys market share in 2016, the transportation industry has emerged as the most significant and leading application segment. The mounting demand for light-weight aircrafts and automobiles has strongly inflated the growth of aluminum alloys in this industry. The automotive industry, vulnerable to the economic saga of Asia Pacific and Europe, in particular is a prime consumer of aluminum alloys.

A number of factors had their vital contributions in the growth of Asia Pacific aluminum alloys industry. A major surge in the construction activities, as well as in the marine and automotive industries signify the regional growth of aluminum alloys market. Moreover, rapid industrialization in the emerging economies including India and other countries of Southeast Asia has collectively contributed toward the regional market growth. Accounting for over 60% of the overall industry share in 2016, the dominant Asia Pacific aluminum alloys market is projected to record a CAGR of 5.5% over the period of 2017-2024. The upsurge in purchase parity and robust growth in the GDPs of countries including India, China, and Japan has provided a significant impetus to the passenger car sales in Asia Pacific region. As per the report, the Global Automotive sales in 2011 was over 80 million units and have raised to 90 million units in 2016. With this soaring automotive sale, the rising demand for light weight alloys have stimulated aluminum alloys market to offshoot.

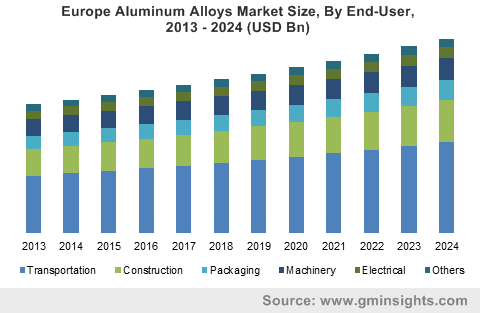

Europe Aluminum Alloys Market Size, By End-User, 2013 - 2024 (USD Bn)

As per the International Air Transport Association (IATA), there has been an exponential increase in the number of flyers from 2011 to 2016, where the figure charted up from 3 billion to more than 3.7 billion. Moreover, in the next two decades, this number is likely to double, owing to the rapidly growing air travel in countries such as UK, India, China, and US. The pickup in the demand for aluminum alloys in the aviation industry is primarily driven by the significant rise in the air travel trends. Eventually, there has been a gradual increase in the delivery of commercial aircrafts which is in turn paving a way for aluminum alloys industry to prosper. A report by Global Market insights, Inc., states that Aluminum alloys market, which crossed its USD 100 billion mark in 2016 is further anticipated to record a CAGR of more than 5% over the period of 2017-2024.

Where on one hand aluminum alloys market has drawn rewarding avenues form the automotive industry, the construction sector’s role in the overall market is also appreciable. The construction industry being another mainstay of the global aluminum alloys market, collected revenue worth USD 20 billion in 2016. The light weight and strength gives aluminum an upper hand over iron and steel products in the construction sector. Driven by the rising construction projects in highly populated cities, the aluminum alloys market from this application is set to generate revenue over USD 35 billion by 2024.

On the product front, wrought alloy and cast alloy are the two popular categories of aluminum alloys. The wrought alloy is anticipated to gain a significant share of aluminum alloys market, owing to its light-weight and high tensile strength properties. Cast alloys on the other hand will pick up demand from specialty engineering and from specific requirement of mechanical parts. The ability of customization of cast alloys to provide desired characteristics pertaining to specific applications will propel the product demand.

Aluminum alloys industry demand will linearly grow on the account of rise in need for performance products in the end-use industries. Several manufacturers are investing in R&D and strategic acquisitions, to increase the product’s efficiency. Presence of such high-end companies especially in Germany, France and UK will set Europe aluminum alloys market to spur over the years. In 2011, Kaiser Aluminum acquired Alexco LLC to broaden their offerings of products especially for the aerospace sector. Other such players operating in this market include Alcoa, United Company RUSAL, Constellium, Aluminium Bahrain, Dubai Aluminium Company, Aleris International, UACJ Corporation, Rio Tinto Alcan, IBC Advanced Alloys Corp., Norsk Hydro, Kobe Steel, ERAMET, Aluminum Corporation of China, and Magna International Inc.