Aerospace & defense fluid conveyance system market to accrue commendable proceeds via technological advancements over 2018-2024, service agreements to characterize industry progression

Publisher : Fractovia | Published Date : May 2018Request Sample

Over the last few years, aerospace & defense fluid conveyance system market has garnered immense recognition across the ever-evolving global aviation sector. Owing to the rapid pace of globalization, the volume of air travel and air freight transportation has expanded at an unprecedented scale. This has necessitated the major firms partaking in aviation vertical to focus on ramping up the manufacturing of aircrafts – a factor that has favorably influenced the aerospace & defense fluid conveyance system industry share. In addition to this, the growing need of developing advanced engines and other progressive aircraft components has invariably translated into regular advancements in fluid conveyance technology.

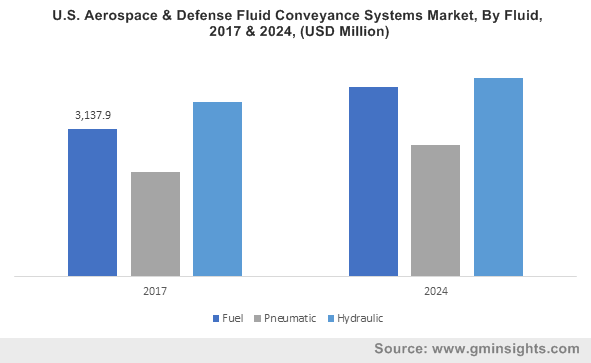

U.S. Aerospace & Defense Fluid Conveyance Systems Market, By Fluid, 2017 & 2024, (USD Million)

In this regard, it is quite imperative to take note of the high-grade products that are being launched by major aerospace & defense fluid conveyance systems market participants. For instance, in 2014, Eaton Corporation had presented a cutting-edge corrosion-resistant plating that significantly outperforms all the other prevailing technologies in the industry. The plating technology, named as Dura-Kote, apparently enables Eaton’s fluid conveyance system to be rated up to a commendable 1,000 hours of corrosion resistance. The technology has further complied with American Society for Testing and Materials (ASTM) B117 salt spray requirements and has even exceeded Society of Automotive Engineers (SAE) J514 standards.

Elaborating further, the unveiling of Dura-Kote plating technology has been widely appreciated across the aerospace & defense fluid conveyance systems industry, given that it provides three times more protection compared to earlier plating technologies. Apparently, the launch of such advanced technologies has eventually provided a commendable boost to this business sphere. With the competitive landscape of aerospace & defense fluid conveyance system market being swamped by biggies along the likes of Encore Group, Parker Hannifin Corporation, Triumph Group, GKN Aerospace, and ITT Corporation, technological progressions and product upgradation seem rather imminent.

Aerospace & defense fluid conveyance systems industry trends: Service agreements signed between market players and renowned airlines to open up new business avenues

In order to lower the cost of ownership, reduce maintenance costs, and offer the highest possible fleet reliability, well-known airlines are now focusing on collaborating with fluid conveyance system manufacturers. Emirates, the acclaimed Dubai based airline, had inked a ten-year after-market services contract with Unison Industries in 2016. According to the terms of the agreement, Unison would provide extensive support to the largest GP7200 and GE90 engine fleets of Emirates until the year 2025.

Apparently, the services that would be extended by the U.S. headquartered aerospace & defense fluid conveyance system market giant include manufacture and repair of power and control harnesses, ignition systems, and most importantly the maintenance of fluid conveyance system for fuel, air, hydraulics, and oil engines of Emirates’ aircrafts.

Speaking in the similar context, in 2015, yet another globally renowned airline, Qatar Airways, has signed a ten-year material services deal with Unison Industries. With an unprecedented fleet growth rate, the airline has been focusing on repairing its fluid conveyance system in aircrafts to ensure they operate effectively and deliver highest performance.

Apparently, the latest contract would cover component repairs for all engine lines in the fleet of Qatar Airways which includes the GP7200, GE90, GEnx, V2500, CFM, and CF6. Moreover, the agreement would allow Unison to support the engine lines of Qatar’s aircrafts up to the year 2024 and upkeep the fluid conveyance systems for oil, hydraulics, oil, and air.

Considering the aforementioned instances of service agreements, the commercialization potential of aerospace & defense fluid conveyance system industry is bound to witness remarkable upswing in the ensuing years.

Speaking of the regional growth prospects, North American region is likely to persist as the highest revenue contributor for the global aerospace & defense fluid conveyance systems industry in the times to come. In fact, according to a research report by Global Market Insights, Inc., North America has been forecast to apportion more than 50% revenue share of this business space. All in all, with significant rise in air travel and upsurge in the number of ageing aircrafts across the globe, the worldwide aerospace & defense fluid conveyance system market share is projected to surpass USD 22 billion by 2024.