U.S. baghouse filters market for woodworking industry to amass huge revenue via furniture & fixture sector over 2016-2024, Pennsylvania to majorly boost the regional landscape

Publisher : Fractovia | Published Date : June 2017Request Sample

U.S. baghouse filter market revenue for the woodworking industry is set to experience a striking growth over the years ahead, subject to the extensive use of the product for flooring, veneer, industrial woodworking, lumber, cabinetry, furniture & fixture, windows & doors, composite panels, and architectural woodworking. High end user spending on renovation and repair activities carried across the woodworking sector in the region will profitably impact the business landscape. Thriving window and door market, which is expected to accumulate a revenue of more than USD 137 billion by 2024, is slated to boost the U.S. baghouse filter market trends for the woodworking industry. According to Global Market Insights, Inc., “U.S. baghouse filters market for the woodworking industry, which was estimated at USD 60 million in 2016, is predicted to accumulate an income of more than USD 85 million by 2024.”

Strict legislations enforced by the NFPA (National Fire Protection Association) and OSHA (Occupational Safety and Health Administration) to ensure a safe and healthy working environment for the factory employees will generate new growth opportunities for the U.S. baghouse filter industry in the woodworking sector. High customer expenditure on home furnishings and smart furniture coupled with easy accessibility of effective distribution channels will soar U.S. baghouse filter market size for the woodworking industry.

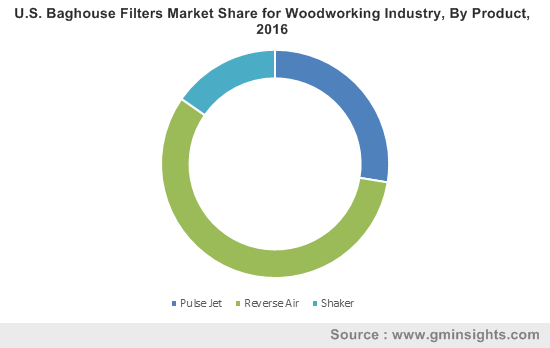

U.S. Baghouse Filters Market Share for Woodworking Industry, By Product, 2016

U.S. baghouse filter market for the woodworking industry from composite panel applications are projected to record substantial gains of more than 3.5% over the coming timeline owing to wide product popularity across commercial and residential constructions. U.S. baghouse filter industry share for the woodworking sector in veneer is estimated to grow at a CAGR of 3.5% over the coming years.

High product demand for construction activities along with its escalated need for maintaining cleanliness at the workplace will push U.S. baghouse filter industry for the woodworking sector in cabinetry, which is slated to record a CAGR of 4% over 2016-2024. Lumber applications are expected to contribute more than USD 20 million toward U.S. baghouse filter market for the woodworking industry by 2024. The growth can be credited to the huge presence of planning mills and sawmills in Texas accompanied by comfortable transport facilities and efficient distribution activities.

Taking into consideration the topographical trends, Texas is anticipated to contribute more than USD 3.5 million to U.S. baghouse filter industry for the woodworking sector by 2024, subject to the escalated product use across the furniture sector. Florida baghouse filter market for the woodworking industry is projected to record a CAGR of 3.5% over 2016-2024, driven by the large-scale presence of reputed lumber manufacturers such as Rex Lumber and Kempner Sawmill firms in the state. It is expected to considerably fuel the growth of U.S. baghouse filter industry for the woodworking sector in the near future.

Pennsylvania is projected to make substantial contributions towards U.S. baghouse filter market share for the woodworking sector over the coming years. The growth can be attributed to the favorable regulatory norms coupled with technological advancements in sawing, milling, and cutting methods.

California industry is also expected to substantially push U.S. market revenue over the coming seven years. High consumer spending on architectural activities as well as interior designing events across the state will accelerate the growth. U.S baghouse filter market size for the woodworking industry in Utah from the furniture & fixture sector is projected to grow at a cumulative rate of 4% over the coming timeframe. High infrastructural development accompanied by the rising trend for cost-effective & smart furniture across commercial and residential sectors will propel the revenue.

Pulse jet, shaker, and reverse air bags are few of the major baghouse filter products. U.S. baghouse filter industry for woodworking sector from pulse jet products is anticipated to hit USD 25 million by 2024, registering an annual growth rate of 3.5% over the coming seven years. The product’s ability to filter out fine dust particles with the help of high air pressure along with low maintenance costs will multiply the profits.

Reverse air baghouse filter market size for the woodworking sector in the U.S. is projected to surpass USD 45 million by 2024, driven by its capability of providing an efficient performance under high thermal conditions and thus improving the shelf-life of dust baghouse filter.

Donaldson Company Incorporation, Nederman Mikropul GmbH, Scientific Dust Collectors, Camcorp Incorporation, Clarcor Industries, Imperial Systems Incorporation, SLY Incorporation, Airex Industries Incorporation, Griffin Filters, Staclean Diffuser Company LLC, Tarmac International Incorporation, Baghouse America, W.L. Gore & Associates Incorporation, Amerair Industries, Aquest Corporation, FLSmidth & Company A/S, A.T Dust Collectors, Aircon Corporation, and U.S. Air Filtration Incorporation are the major players of U.S. baghouse filter industry for the woodworking sector.